- Thu. Apr 25th, 2024

Latest Post

State Program Provides On-the-Job Technology Training for Licking Heights Students

Licking Heights Local Schools has partnered with the Governor’s Office of Workforce Transformation to offer a High School Tech Internship program to 10 high school students. This program provides students…

Accountants are optimistic about the global economy in 2024

A new study by ACCA and IMA has found that finance professionals are feeling optimistic about the global economy. The Global Economic Conditions Survey (GECS) shows a rise in confidence,…

LG’s TV business bounces back to profitability thanks to increased demand in Europe and the rise of streaming services

In the first quarter, LG Electronics’ TV business returned to profitability due to the recovery of demand in Europe and the increasing popularity of streaming services. The South Korean electronic…

As Economic Growth Slows, Germans Consider Longer Work Hours and Delayed Retirement

German politicians and business leaders are addressing a controversial topic that was once considered taboo: the issue of German workers not putting in enough hours. The country’s weak economy has…

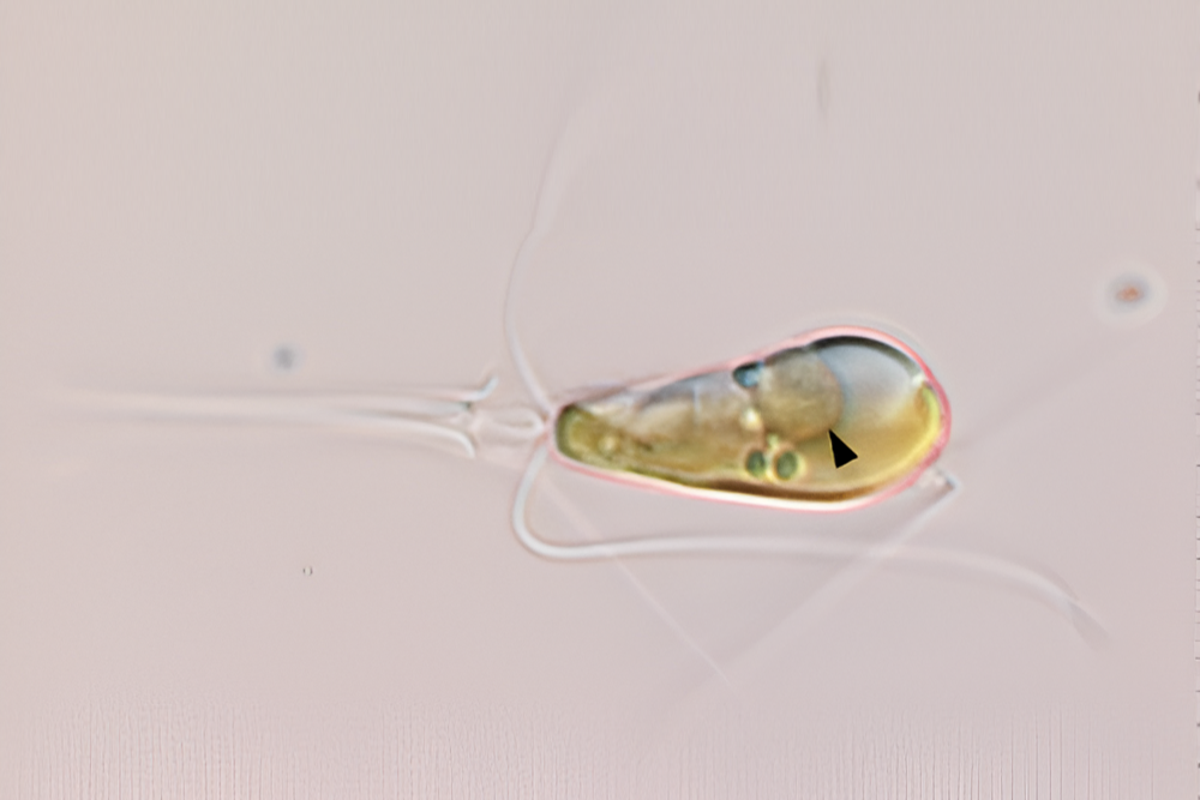

Two separate lifeforms unite for the first time in one billion years

Sign up for our Voices Dispatches email for a full digest of all the best opinions of the week. Stay informed with our free weekly Voices newsletter. For the first…

Meet Kiah Helget: Latest Updates on News, Sports, and Jobs

New Ulm Cathedral senior Kiah Helget had a standout performance in a recent softball game against Nicollet at Harman Park. Her two-run home run sealed the deal for the Greyhounds,…

FBI Investigates Video Released by Hamas Featuring Hirsch Goldberg-Paulin

Hirsch Goldberg-Polin, an individual who holds both Israeli and American citizenship, was kidnapped by Hamas militants on Black Saturday on October 7. According to reports from the Kan-11 television channel,…

RFID’s Advantages for Retailers, Associates, and Consumers: Insights from RetailTech Research

RFID, or radio-frequency identification, is a technology that goes beyond just ensuring inventory accuracy for retailers. In fact, it offers numerous benefits for retailers, associates, and consumers alike. This report…

Today’s Date, Theme, and Historical Significance

World Malaria Day 2024 is observed on April 25th each year to raise awareness about the serious mosquito-borne illness. This year’s theme, “Accelerating the fight against malaria for a more…

Challenges to Legal Protections: The Impact of AI on the Constitution

The integration of artificial intelligence (AI) in various sectors like technology, law enforcement, and courts presents unique challenges regarding accountability, the extension of “human” rights to autonomous systems, and the…