- Sat. Apr 20th, 2024

Latest Post

Impressive or Frightening?; Community responses to the latest technology that transforms AI images into videos

Locals are sharing mixed reactions on the new technology that can turn AI photos into videos. Some people find the innovation impressive, while others are left feeling terrified by the…

Different Perspectives on the Business Impacts of Hennepin Avenue Construction

Construction crews in Minneapolis are working on a major reconstruction project that impacts dozens of Uptown businesses. Robert Sorenson, owner of Bobby Beads, is closely monitoring the progress as he…

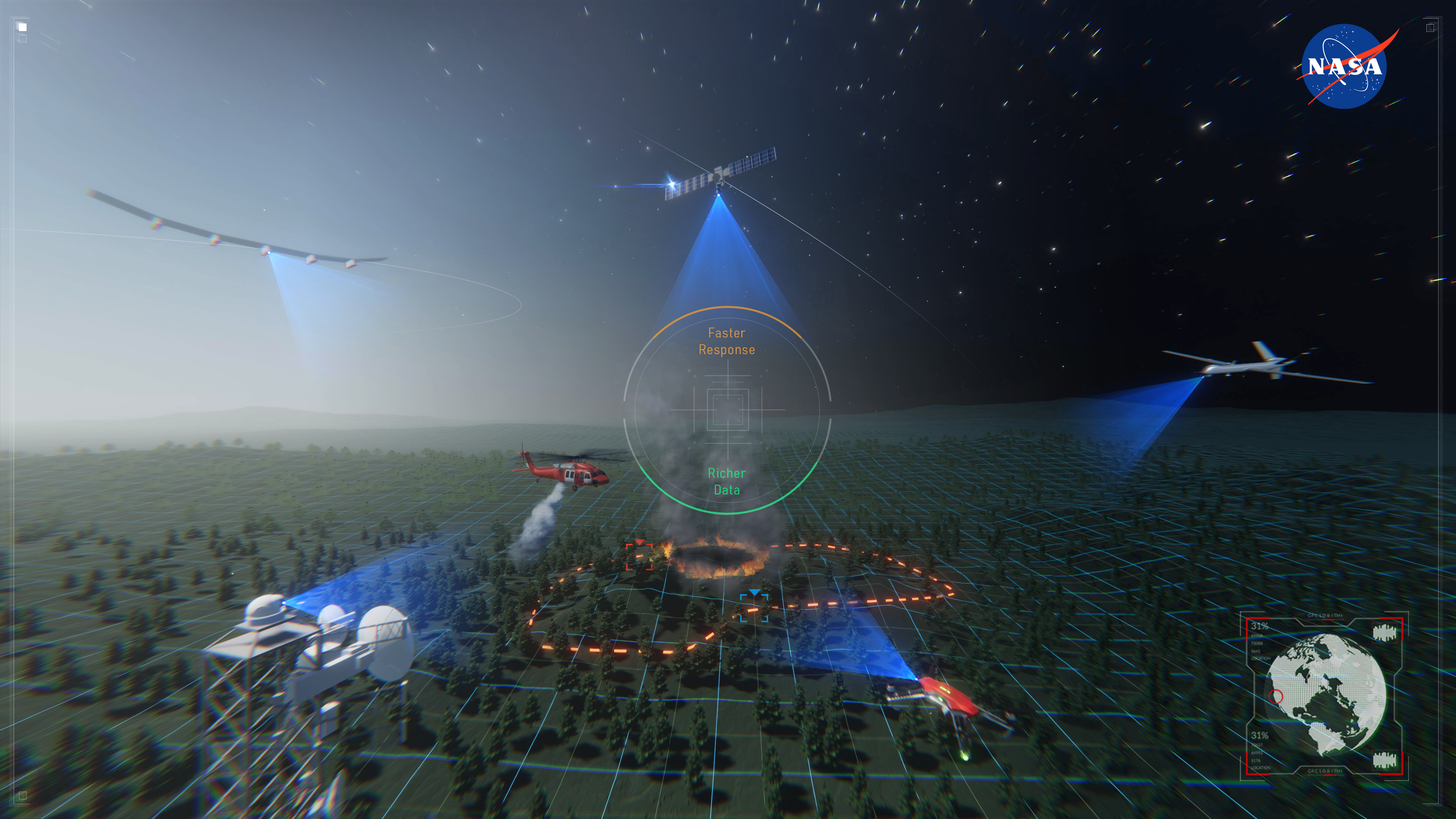

NASA and FAA Collaborating to Implement Innovative Wildland Fire Technologies

NASA and the Federal Aviation Administration (FAA) have joined forces to establish a research transition team focused on developing technology for wildland fire management. This initiative comes in response to…

Nico Young, NAU runner, secures spot in 2024 Olympics trials

Nico Young, a runner from Northern Arizona University (NAU), has set multiple records and won national championships. Now, he is aiming for a new title as an Olympic athlete. Young…

Baker Technology Answers Shareholder Questions Before AGM

Baker Technology Limited (SG:BTP) recently published an update, expressing appreciation to its shareholders for their involvement. The company acknowledges the questions submitted by shareholders ahead of the Annual General Meeting…

Potential Measles Exposure at Children’s Museum During Eclipse Viewing

The rise of measles outbreaks in the U.S. can be attributed to the anti-vax movement, with officials declaring emergencies due to the spread of the disease. People attending events like…

Trump’s stock market bet on Truth Social is in jeopardy as platform crashes

The US presidential candidate is relying on the social network Truth Social to raise money for his election campaign, but this plan is now in jeopardy. Donald Trump’s supporters knew…

Discovering Podcast: Innovations in the WorldTour featuring POC Sports

Alison is a familiar face on social media and on the podium, showcasing her love for movement through dancing, riding, and outdoor activities. Her passion for staying active is contagious,…

Santa Rosa’s Biggest Bounce House in the World

Santa Rosa will be hosting the “World’s Largest Bounce House” and six other massive inflatable attractions this upcoming weekend. The Big Bounce America tour will be taking place at the…

SLO County Behavioral Health presents awareness exhibitions across county libraries

The San Luis Obispo County Behavioral Health Department recently established a partnership with County Libraries to provide free-to-attend “awareness galleries” as a way to educate locals on mental wellness and…