- Wed. Apr 24th, 2024

Latest Post

The University of Illinois Urbana-Champaign Introduces New Siebel School of Computing and Data Science within The Grainger College of Engineering

Chancellor Robert J. Jones of the University of Illinois highlighted the importance of interdisciplinary and collaborative work in research and education for computing and data science. The establishment of the…

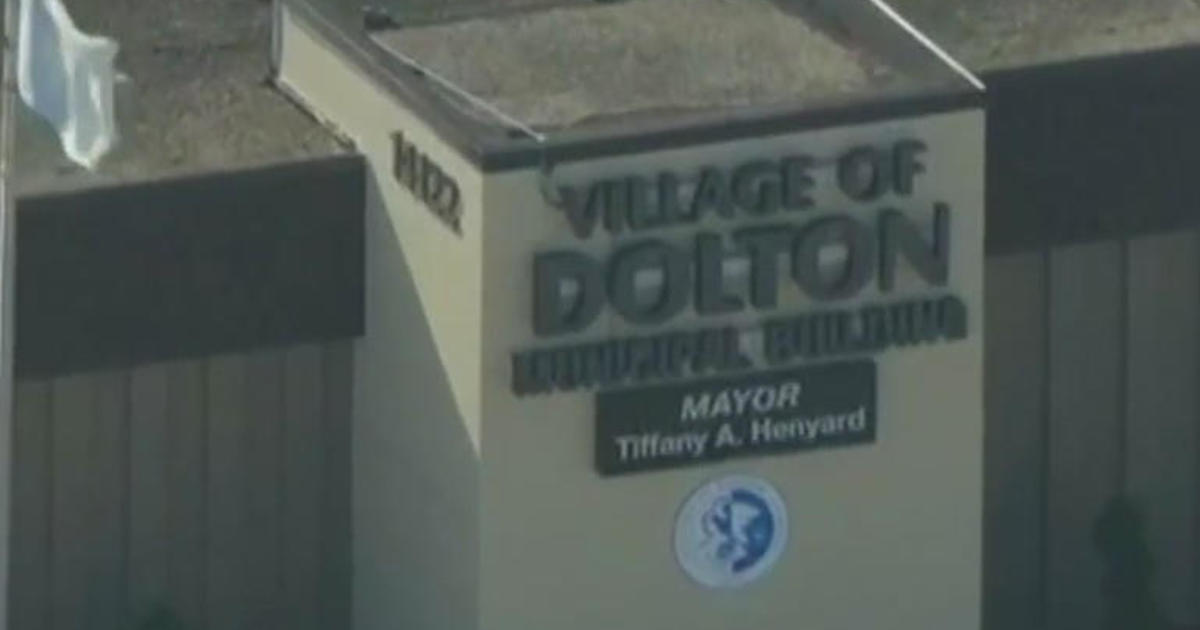

Barbershop owner in Dolton takes legal action against village for refusing business license

A barbershop owner in Dolton, Illinois is taking legal action against the village, mayor, and village leaders over the improper denial of a business license. Tyrone Isom Jr. purchased a…

Wellness Weekly: National Drug Take Back Day on April 27th with Assistance from Tria Health Pharmacists

Employees and their families enrolled in a Marquette medical plan have access to Tria Health, a free and confidential service that offers assistance with medications. Tria Health pharmacists can ensure…

How Nelly Korda, the World’s No. 1 Golfer, Perfects Her Full-Swing Wedges: Top Tips to Improve Your Game

Nelly Korda is an impressive player in the LPGA Tour, having won five tournaments in a row, a feat only achieved by two other players. While her entire game is…

April 24, 2024: Latest Updates in Business

Business news – April 24, 2024 WeDo Fudge and Cascade Caramel are excited to announce the reopening of their drive-thru sweet shop for the season on April 30th. Located at…

Usain Bolt, ambassador for T20 World Cup, foresees significant growth for cricket in the USA

Bolt is looking forward to experiencing the vibrant party atmosphere in the Caribbean, complete with dancing, music, and high energy. He is excited to see how cricket will make an…

Health officials in the US issue a warning about fake Botox injections

U.S. health officials have issued a warning about counterfeit Botox injections that have made 22 people sick, with half of them requiring hospitalization. The Centers for Disease Control and Prevention…

Catherine Rogers Named Athlete of the Week by Advantage Federal Credit Union

Catherine Rogers has been named the Advantage Federal Credit Union’s Girls Sports Athlete of the Week with over 30,000 votes. The senior from Webster Thomas scored in multiple ways during…

Morehead State University’s Veterinary Technology program ranked 13th nationwide and top in the state

Morehead State University’s veterinary technology program has received national recognition once again, being ranked among the top programs in the nation by BestColleges baker’s dozen and is also the top…

Tubi Teams Up with DAZN to Introduce Women’s Soccer Channel, MMA, and Boxing into Their Lineup

FC Barcelona will face Chelsea FC Women in a UEFA Women’s Champions League match. The match is highly anticipated and fans are looking forward to seeing which team will come…