- Wed. Apr 24th, 2024

Latest Post

Reports indicate that health care spending is expected to increase due to the introduction of Ozempic-like drugs.

Two new reports released on Wednesday indicate that spending on GLP-1 drugs like Ozempic and Wegovy significantly increased last year and is projected to continue rising in the future, causing…

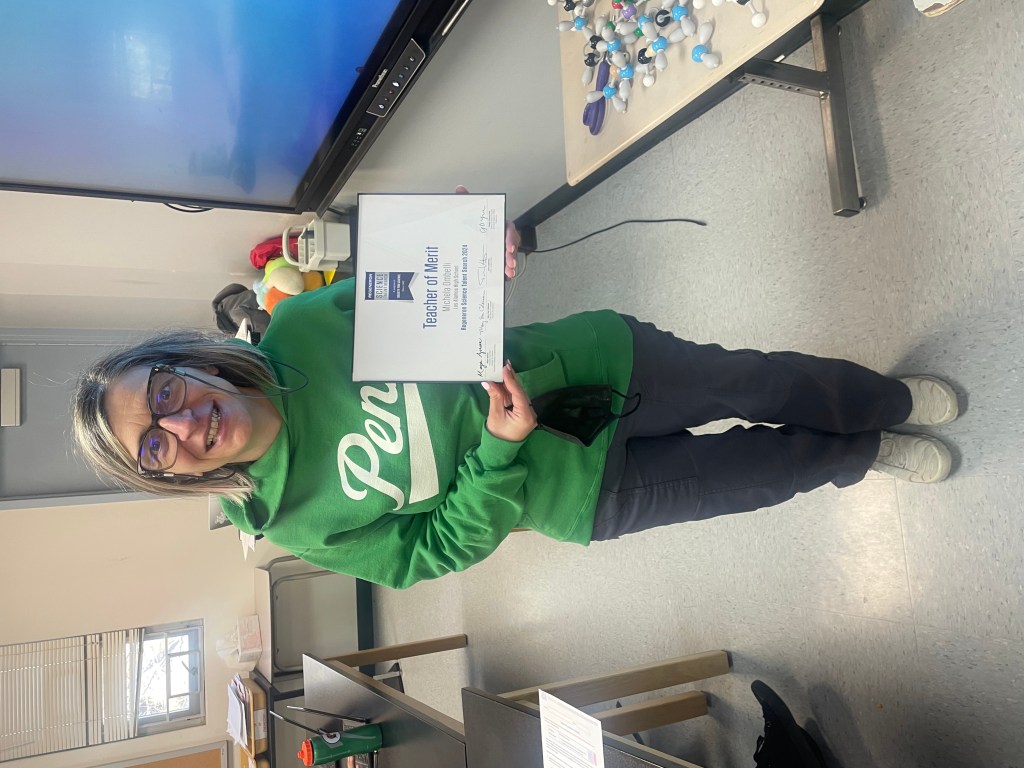

Dr. Michela Ombelli of LAHS Recognized as Regeneron Science Talent Search Teacher of Merit by Los Alamos Reporter

Dr. Michela Ombelli, a science teacher at Los Alamos High School, was recently honored with a 2024 Teacher of Merit Certificate by the Regeneron Science Talent Search. The Regeneron Science…

Impressive AI anime character portraits of Seiya, Naruto, Vegeta, and others

In recent years, images created using artificial intelligence have advanced significantly. What started with incomprehensible compositions has now evolved to images that almost mirror the work of human artists. Instagram…

OCB’s General Director, Mr. Nguyen Dinh Tung, Steps Down

Mr. Nguyen Dinh Tung recently resigned as General Director of Orient Bank (OCB) after more than a decade of management. He made this decision in order to focus on his…

Oshkosh High Schools Relocate Graduation Ceremonies to Kolf Sports Center on UWO Campus

Oshkosh North and West high schools will be relocating their graduation ceremonies to the UW Oshkosh Kolf Sports Center due to uncertainty surrounding the Oshkosh Arena. The graduation ceremonies will…

Sports News and Job Opportunities

On Tuesday, McDonald’s attempted seventh-inning comeback fell short as Mineral Ridge secured an 8-7 road victory over the Blue Devils. This came after McDonald suffered a late loss at home…

Japan’s Skater of the Year Award Goes to Three-Time World Champion Sakamoto Kaori

Sakamoto Kaori had a remarkable 2023-24 season as she was named Skater of the Year at the Japan Skating Federation awards ceremony. She made history by becoming the first woman…

36th Annual Health Care Golf Classic hosted by Franklin Memorial Hospital on July 12th

Franklin Memorial Hospital is thrilled to announce the 36th annual Health Care Golf Classic on July 12 at Sugarloaf Golf Club. The event aims to raise $30,000 for two local…

Senate Approves Law Banning TikTok in the United States

The US Senate recently approved a foreign aid package that contains legislation specifically addressing TikTok, the popular video-sharing platform owned by Chinese company ByteDance. This legislation, once made law, will…

Nikola Jokić: NBA and Denver Police Investigating Reported Incident Involving Two-Time MVP’s Brother

Nikola Jokić is being defended in the photograph, taken during Game 2 of the Denver Nuggets’ first round playoff series against the Los Angeles Lakers in the 2022 NBA Playoffs…

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/OUMBU75EGFHLXB2HFGICHQKQPM.jpg)