- Fri. Apr 26th, 2024

Latest Post

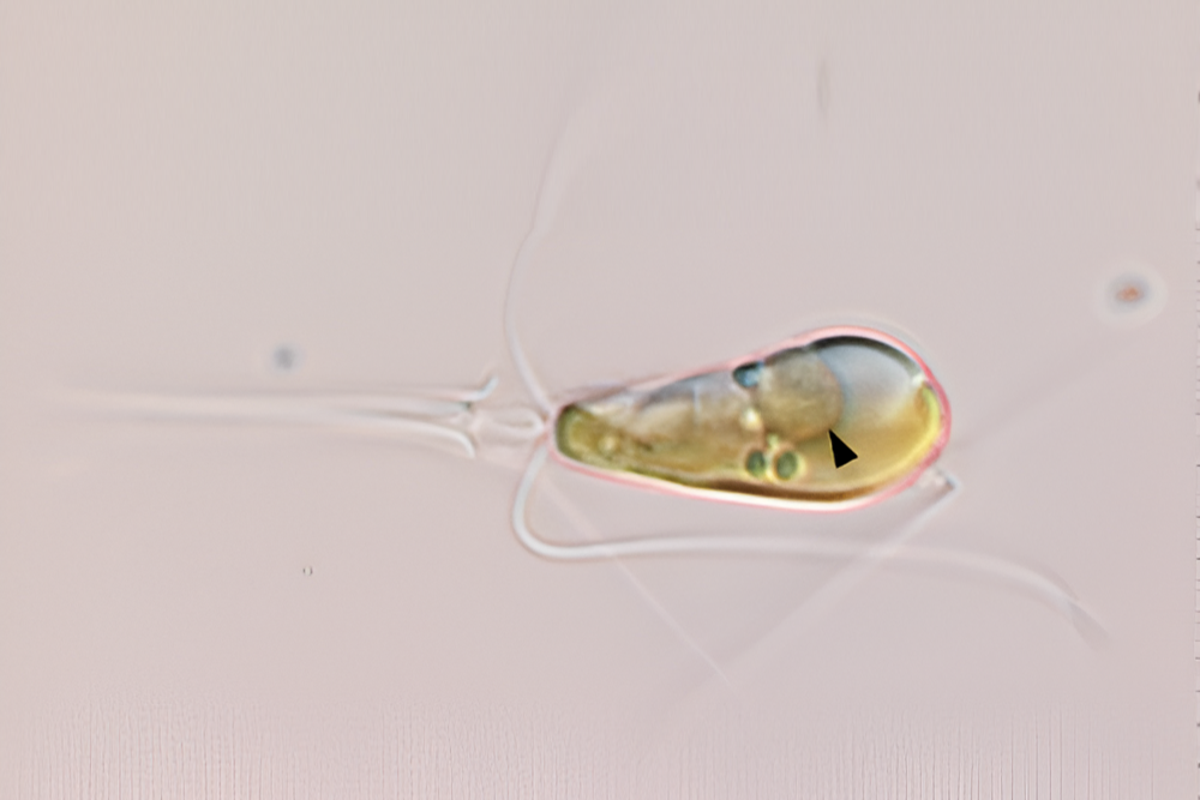

First time in a billion years: Two lifeforms unite as one

Sign up for our Voices Dispatches email to receive a comprehensive digest of the best opinions of the week. Additionally, subscribe to our free weekly Voices newsletter for more updates.…

Honeywell’s innovative hydrocracking technology converts biomass into sustainable aviation fuel

Honeywell has introduced a new hydrocracking technology that can produce sustainable aviation fuel (SAF) from biomass, significantly reducing carbon emissions compared to traditional fossil-based jet fuels. This SAF is 90%…

Hazel Dell’s Music World hosting recycling event to prevent guitar strings and other items from ending up in landfills

Matt Gohlke, the co-owner and general manager of Music World in Hazel Dell, recently realized the impact of disposing of his instruments’ old strings. According to TerraCycle, a recycling company,…

Health Department Announcements

The Department of Health in New Jersey is emphasizing the significance of childhood vaccination during National Infant Immunization Week. This annual event highlights the importance of protecting infants and children…

Penn State offensive tackle Olu Fashanu drafted by the Jets

The New York Jets made a move in the NFL draft Thursday night, selecting Penn State offensive tackle Olu Fashanu with the 11th pick after trading down one spot. The…

Secret Delivery of ATACMS Missile System to Ukraine Threatens Crimea in Russia

The United States confirmed on Wednesday that it had secretly delivered a long-range Atacms missile system to Ukraine, a move that has been condemned by Russia. The delivery consisted of…

WindStream and PNOC Collaborate on Hybrid Renewable Technology Project in the Philippines

The Philippine National Oil Co. (PNOC) has partnered with WindStream Energy Technologies India Pvt Ltd., an Indian renewable energy solutions provider, to implement hybrid renewable technology systems in the Philippines.…

Former CIA Officer Shares Tips on Detecting Deception in the Business World

In the world of investing, due diligence is often associated with analyzing financial statements and number crunching to gain a better understanding of a company’s potential. However, there is another…

The prevalence of terms like “commendable” and “meticulous” points to the widespread use of ChatGPT in numerous scientific studies

The librarian, Andrew Gray, has discovered a surprising trend in scientific studies published last year. He found that the use of certain words like meticulously, intricate, commendable, and meticulous had…

New Aviators Sports Bar launches in Mandan

Aviators is the newest business in Mandan, located at 202 West Main Street. The sports bar is owned by a group of five individuals, one of whom is Ryan Deichert,…