- Fri. Apr 26th, 2024

Latest Post

Byron Murphy II Joins Seattle Sports 710AM Plus More Updates

Byron Murphy II was recently on Seattle Sports 710AM show to discuss his experience with the draft, college, and growing up in DeSoto, Texas. The morning after being drafted by…

Three tips for easing stomach discomfort from overeating

According to Doctor Vu Truong Khanh, the Head of the Department of Gastroenterology at Tam Anh General Hospital in Hanoi, overeating can burden the stomach and affect intestinal motility. This…

Argentina calls for increased governmental accountability regarding personal data breaches and evaluates current legislation

In less than two weeks, Argentina experienced a series of significant personal data leaks. The first incident occurred in early April when a cybercriminal published over 115,000 stolen photos from…

Janom Steiner defends prioritizing stability over climate and diversity for the SNB

During the General Meeting of the Swiss National Bank, attendees are eager to share their opinions on what changes the Bank should make. However, Bank Council President Barbara Janom Steiner…

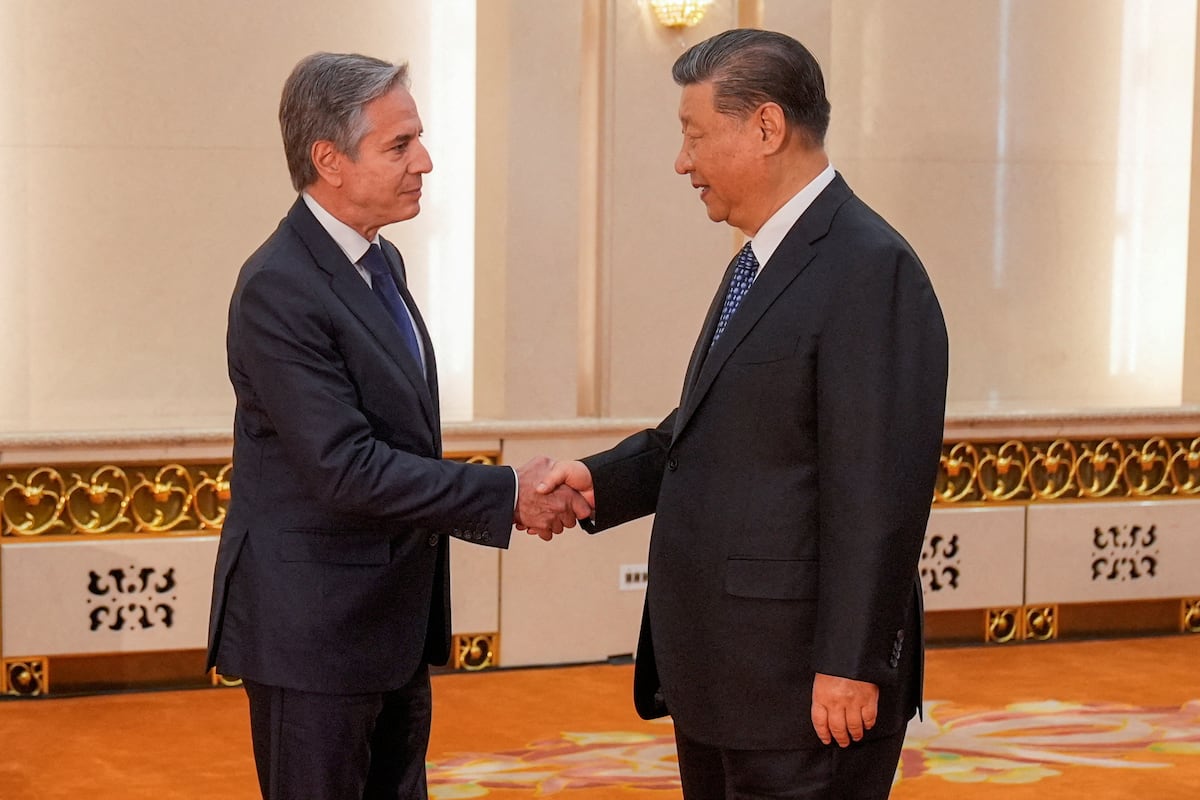

Blinken and Xi pledge to find common ground to mend China-US relations at Beijing meeting

During a recent three-day trip to China, US Secretary of State Antony Blinken met with Chinese officials to discuss the need for “active diplomacy” to avoid misunderstandings and miscalculations. The…

Amazon Dominating the Economy

Once upon a time, Amazon was a quirky website for buying books. Today, it has grown into a massive corporation that has expanded its business into various sectors of daily…

Western Science Center to host Inland Empire Science Festival

Leya Collins, WSC Museum Laboratory Manager, held “Charlotte,” a non-venomous Reticulated Python, as she welcomed both adults and youths to the Inland Empire Science Festival on April 20 at the…

Chipotle puts new ideas on hold following closure of health food spinoff

Over a year since its launch, Chipotle is shifting its focus back to its main brand after the closure of its health food restaurant concept, Farmesa. Farmesa had opened just…

Shreveport woman, 59, with mental health disorder reported missing

Detectives with the Shreveport Police Department are seeking the public’s help in finding a missing 59-year-old woman named Latonia Wade. She was last seen on April 3rd, 2024 and was…

HHS Approves Protections for LGBTQ Health Care Bias

The Biden administration has implemented a new federal rule that strengthens civil rights protections for transgender and other LGBTQ individuals, which could potentially be challenged in court. The final rule,…