- Thu. Apr 25th, 2024

Latest Post

Today’s Date, Theme, and Historical Significance

World Malaria Day 2024 is observed on April 25th each year to raise awareness about the serious mosquito-borne illness. This year’s theme, “Accelerating the fight against malaria for a more…

Challenges to Legal Protections: The Impact of AI on the Constitution

The integration of artificial intelligence (AI) in various sectors like technology, law enforcement, and courts presents unique challenges regarding accountability, the extension of “human” rights to autonomous systems, and the…

The Significance and Evolution of Today: Exploring the Date, Theme, and Historical Events

World Malaria Day is observed each year on April 25th to raise awareness about this serious mosquito-borne illness. This year, the theme is “Accelerating the fight against malaria for a…

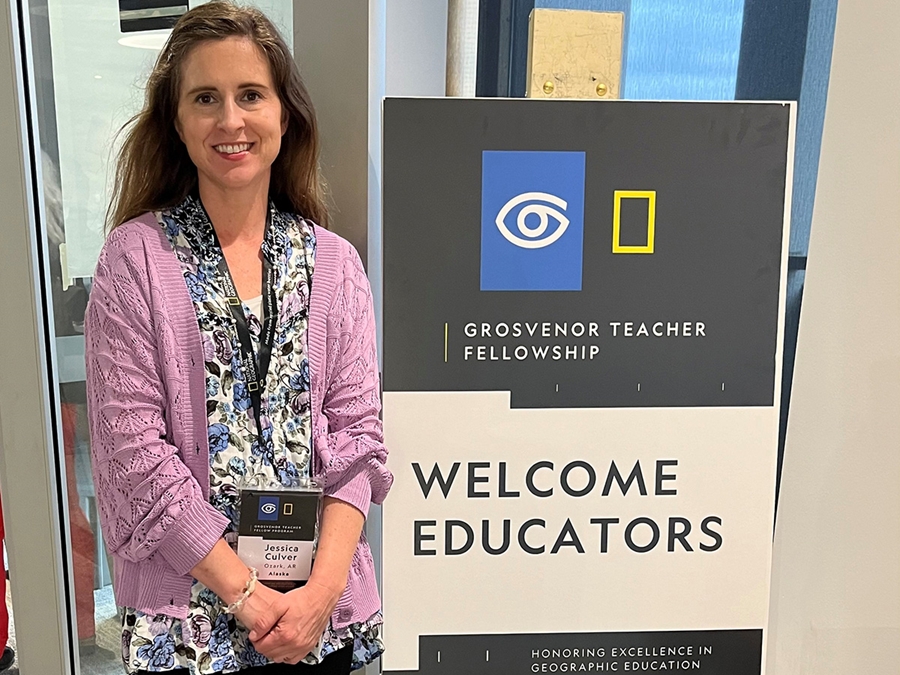

Doctoral Student from the College of Education and Health Professions Chosen for prestigious Grosvenor Fellowship

Jessica Culver, a doctoral student in the College of Education and Health Professions Adult and Lifelong Learning program, has been chosen as a member of the 2024 Grosvenor Teacher Fellowship.…

Oregon Breweries Dominate with 29 Medals at the 2024 World Beer Cup — New School Beer + Cider

The highly respected World Beer Cup awards were held at The Venetian Las Vegas on April 24th, 2024. The competition, created by the Brewers Association in 1996, aims to showcase…

Leaders in life sciences identify key priorities in healthcare

Physicians, researchers, CEOs, reporters, and more gathered in downtown Boston Wednesday night to celebrate STAT’s 2024 STATUS List, which features 50 leaders in the life sciences. Members of this year’s…

The Future of Jobs and the Economy in Texas: An Exploration

Texas currently has over 15 million working Texans, showing steady growth and high levels of jobs and labor force. However, there are uncertainties on the horizon, particularly in terms of…

The World’s Largest Fish Fry makes a triumphant return, providing meals for thousands of attendees

The 71st annual World’s Biggest Fish Fry returned to Paris, Tennessee on April 20, with the Fish Tent opening on April 24. The Fish Tent is the premier attraction of…

Company specializes in kitchen renovations using upcycled furniture and cabinets

FunCycled, a local family-owned business located in Wynantskill, started as a flipping company in 2021. However, over the years, they have expanded their services to include kitchen cabinet painting and…

Texas Rated Best State for Business for 20 Consecutive Years

For the 20th consecutive year, Texas has been named the best state for business in a survey conducted by Chief Executive Magazine. The survey gathers input from the nation’s top…