- Wed. Apr 24th, 2024

Latest Post

Labor to launch an investigation into potential probationary period abuses

The Labor and Social Security Inspection will be focusing on monitoring the use of trial periods by companies, as reported by Cadena SER. The department, led by Yolanda Díaz, aims…

Poland’s Mission to Bring NATO Nuclear Weapons Closer to Russia: Andrzej Duda, Vladimir Putin, Belarus, United States, European Union, and the Global Nuclear Arsenal

Polish President Duda told a newspaper that his country is prepared for allies to deploy nuclear weapons on its territory to enhance security on the eastern flank of NATO. Duda…

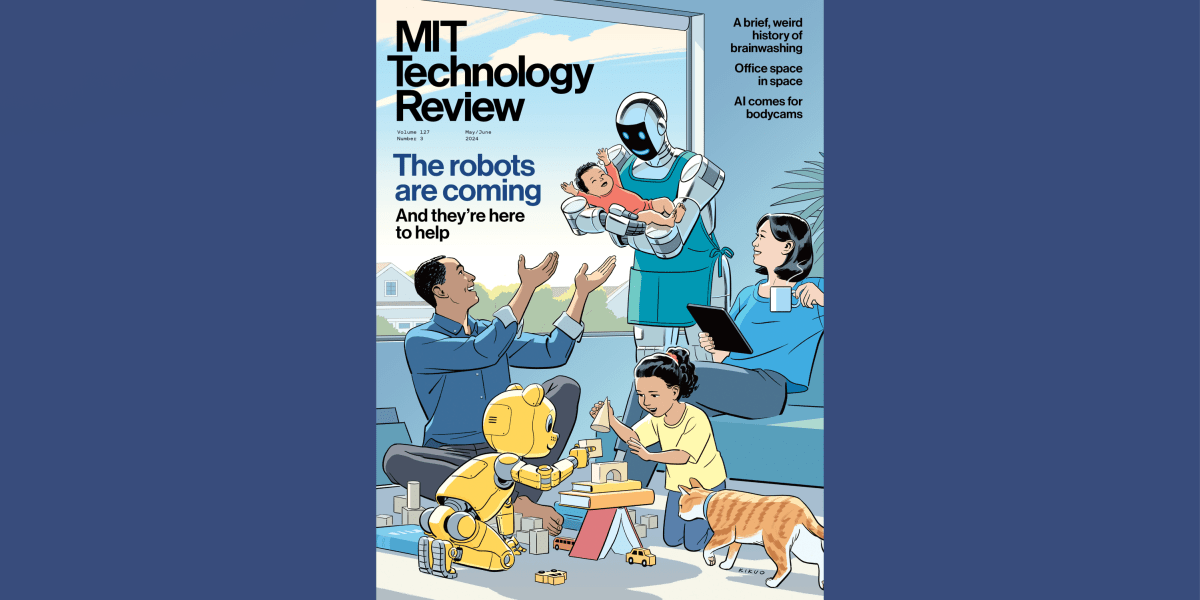

Introducing The Build Issue of The Download

The concept of building is a prominent theme in the tech industry, particularly in Silicon Valley where “Time to build” acts as a rallying cry. However, the future is constructed…

First Quarter 2024 Financial Results for Natural Health Trends Scheduled for May 1st Announcement

Natural Health Trends Corp., a leading direct-selling and e-commerce company that markets premium quality personal care, wellness, and “quality of life” products under the NHT Global brand, will be reporting…

Billie Eilish joins Fortnite in latest update, aggressive emotes removed

Epic Games has recently rolled out an update for Fortnite (v29.30) that includes a new feature designed to filter out certain emotes that are considered aggressive. With this update, players…

Majority union lifts notice period for air traffic controllers strike scheduled for Thursday

A strike called for by all the air traffic controllers’ unions in aviation was expected to be widely followed on Thursday. However, the majority union SNCTA announced in a press…

The US Senate Gives Approval to Military Aid Bill for Ukraine

The United States Senate approved a comprehensive bill on Tuesday that includes a military aid package worth US$95 billion for Ukraine, Israel, and Taiwan. The legislation also includes provisions that…

SEALSQ Enhances Security for Luxury Assets Using NFT Technology

SEAL SQ’s Asset Security utilizes NFT technology to create a unique identifier linked to each luxury item, ensuring ownership and authenticity can be easily verified. By embedding VaultIC155 NFC secure…

T2 Biosystems Announces First Quarter 2024 Financial Results and Business Updates Presentation on May 6, 2024

T2 Biosystems, Inc., a company specializing in the rapid detection of sepsis-causing pathogens and antibiotic resistance genes, announced that they will be reporting their financial results for the first quarter…

Plan to conceal Trump’s constant infidelities with bribery revealed in trial details

The second day of the oral hearing against Donald Trump began with expected anger. The prosecution demanded that Judge Juan Merchan toughen the prohibition on Trump speaking publicly about the…

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/FW5G4PSUF5BFNI34GT6NTZHDLA.jpg)