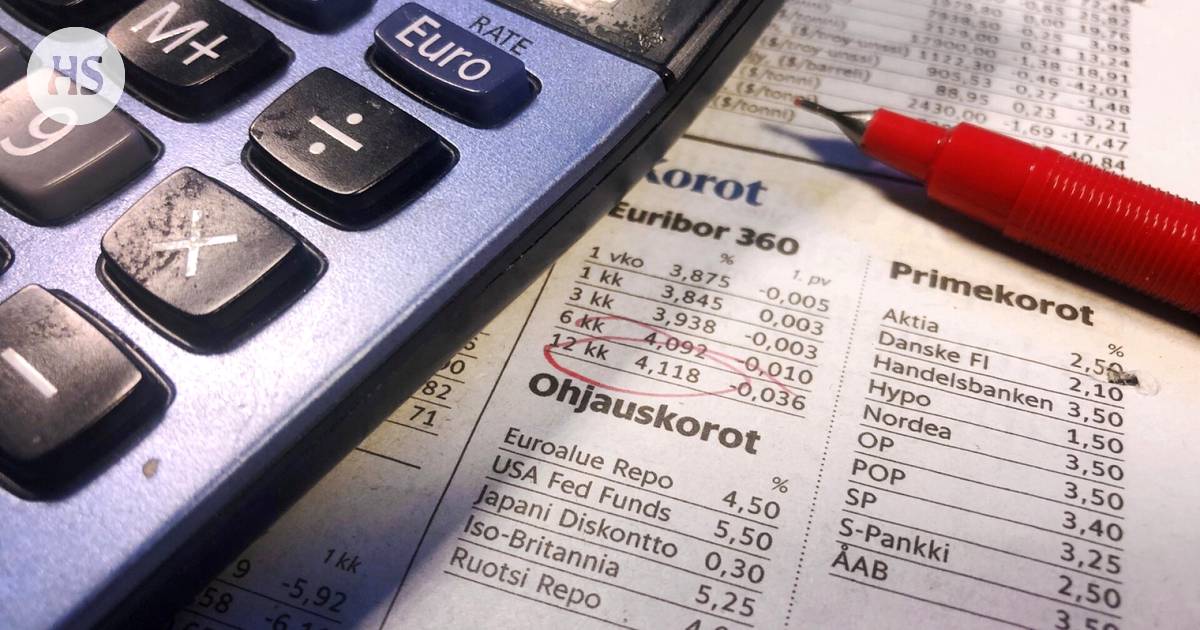

The most common reference interest rate for housing loans in Finland is the one-year Euribor rate. Recently, the rate rose to 3.589 percent, showing an increase from the previous day’s 3.567 percent. Over the past year, this reference rate has fluctuated but has slowly trended downward after reaching a peak of over 4.2 percent last fall.

In comparison to the one-year Euribor rate, shorter-term Euribor rates experienced more moderate shifts. The six-month rate fell nominally to 3.676 percent, while the three-month rate saw a slight increase to 3.714 percent. The movements of these shorter-term rates are closely related to the decisions and announcements made by the European Central Bank (ECB) regarding key interest rates.

Expectations surrounding future interest rate cuts from the ECB were discussed after the bank lowered its key interest rate in June. While the ECB’s goal is to maintain an annual inflation rate of around 2 percent, recent data shows that harmonized inflation in the euro area slowed to 2.5 percent in June. The ECB may consider further interest rate cuts later in the year to achieve its inflation targets.

In Finland, the inflation rate remains relatively low at 0.6 percent, the slowest in the euro area. With ongoing discussions about future ECB decisions, mortgage debtors and homeowners are advised to keep a close eye on market trends and interest rate movements for potential impacts on their financial situation.