- Fri. Apr 19th, 2024

Latest Post

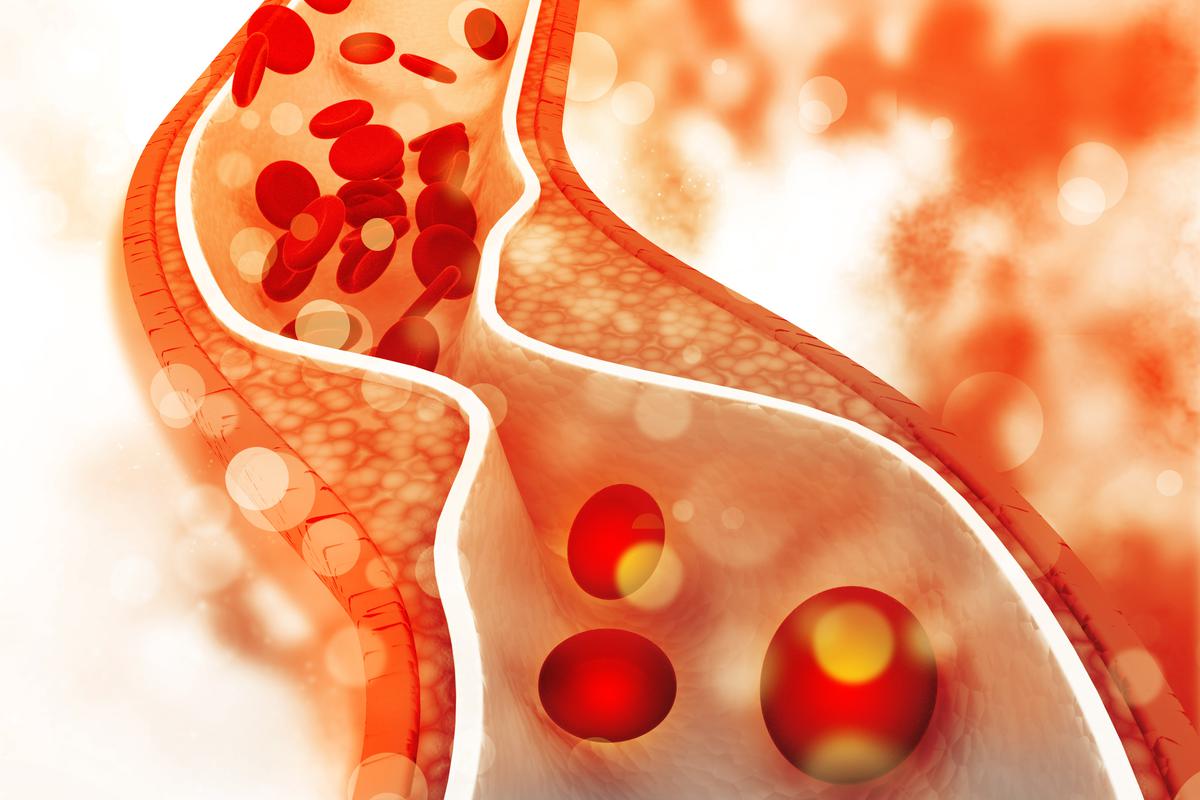

Cholesterol: A Science Quiz

Cholesterol, a type of sterol that is found in animals, plays a crucial role in the body. In fungi, a similar compound called ergosterol performs a role comparable to cholesterol.…

Success on the Road: Latest News, Sports Updates, and Job Opportunities

In Thursday’s Section VI Division 1 flag football game against West Seneca West, Jamestown’s Ella Propheter (24) was seen celebrating with her teammates. According to head coach Steve Propheter, the…

Washington County reverses decision, grants business permit for residential treatment facility near Beaver Lake

Washington County officials recently made the decision to deny a conditional use permit for the Eaglecrest Recovery facility located near Beaver Lake. However, this decision was reversed after county officials…

Former Stanford president receives prestigious National Science Board award

John Hennessy, the former president of Stanford from 2000 to 2016, has been selected as the recipient of the National Science Board’s (NSB) 2024 Vannevar Bush Award. The award, named…

Part 2: Precision Milking Technology is Now Online

Today marks the second part of the series on DeLaval’s new robotic VMS Solutions Technology, also known as batch milking. The VMS Solutions Manager, Jason French, describes batch milking as…

Washington County Grants Business Permit for Residential Treatment Facility Near Beaver Lake

In 2023, a treatment facility proposal was rejected by Washington County officials. The decision was reversed after being told the county was unlikely to prevail if the case was moved…

One Year Later: Revisiting the Health Department’s Investigation of Dave’s Sushi

Nearly a year after the Gallatin City-County Health Department (GCCHHD) ordered the closure of Dave’s Sushi in Bozeman due to toxins suspected to come from morel mushrooms that affected 50…

Leaders’ Perspectives on Achieving Universal Health Coverage

Join us for a fireside chat on Universal Health Coverage (UHC), where we explore the real-world challenges and successes that leaders face in making healthcare accessible and affordable worldwide. This…

Three Entrepreneurs Who Impressed Galperin at the Llao Llao Forum

The Llao Llao Forum brings together high-impact businessmen and entrepreneurs in Bariloche, a picturesque landscape, and dedicates a lot of time, money, and energy to its program, focusing this year…

Media report claims Israeli missiles struck a site in Iran | Global News

According to ABC News, Israeli missiles struck a site in Iran following a drone strike by Iran on Israel in response to an attack at the Iranian embassy in Syria.…