- Thu. Apr 25th, 2024

Latest Post

Texas Rated Best State for Business for 20 Consecutive Years

For the 20th consecutive year, Texas has been named the best state for business in a survey conducted by Chief Executive Magazine. The survey gathers input from the nation’s top…

Healthcare leaders’ advice on how to begin

This on-demand webinar is available for viewing at your convenience. It features a panel discussion from healthcare leaders who share their insights on building a culture of innovation within their…

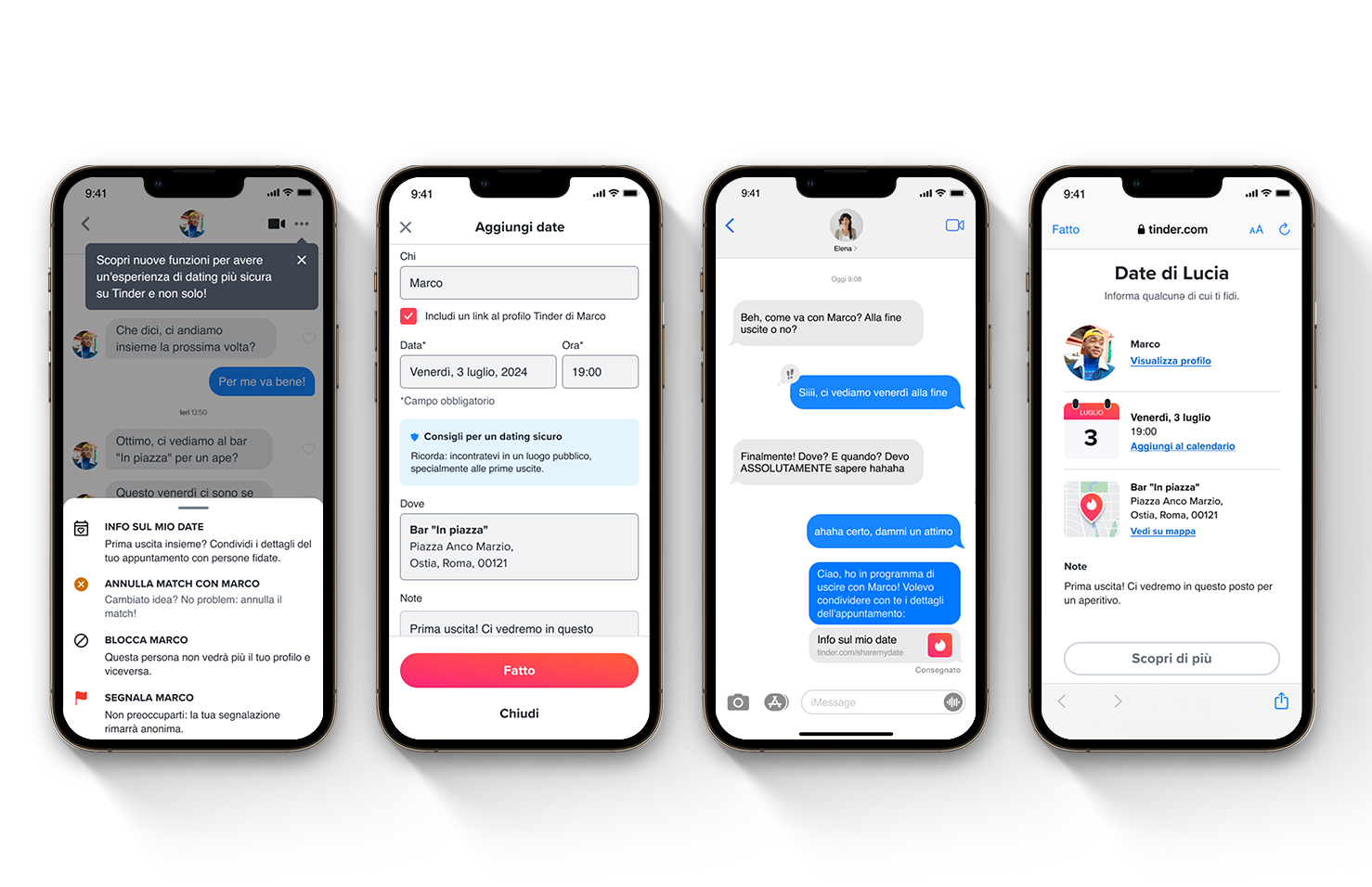

Tinder introduces Share My Date: A new feature for secure dating

Tinder, the leading dating app, has announced the upcoming launch of a new feature called “Share My Date.” This tool will allow users to easily share details about their upcoming…

French President Emmanuel Macron successfully scores a penalty in a charity match supporting his wife’s foundation.

French President Emmanuel Macron participated in a charity football match where he played the full 90 minutes alongside former football stars Didier Drogba, Didier Deschamps, and Eden Hazard. The event…

White House Review Clears Biden’s Association Health Plan Rule

The White House has finished reviewing a final rule regarding the use of association health plans, which are seen as a more affordable option for small businesses and self-employed individuals…

Attention Deficit Hyperactivity Disorder: A Call for Recognition and Understanding

In recognition of Women’s Health Month, ADDitude is advocating for more research on women with ADHD. Currently, there is a significant lack of research on ADHD in women, leading to…

Analyzing Key Metrics vs. Estimates

Align Technology (ALGN) reported revenue of $997.43 million for the quarter ended March 2024, showing a 5.8% increase compared to the same period last year. The earnings per share (EPS)…

Superior Health Foundation Grants Spring Awards for 2024

The Superior Health Foundation recently hosted its 2024 Spring Grants Celebration, where they awarded over $200,000 in grants to various health-centered organizations. One of the recipients was the Negaunee Public…

The resignation of Spain’s prime minister is being considered

Spanish Prime Minister Pedro Sánchez is contemplating stepping down from his position, which he has held since 2018, following a corruption complaint against his wife, Begoña Gómez. The socialist politician…

Amazon faces 10 million euro fine

The Antitrust has levied a fine of 10 million euros on two companies within the Amazon group, specifically the Luxembourg-based Amazon Services Europe and Amazon EU, for engaging in an…