- Thu. Apr 25th, 2024

Latest Post

Bladen County’s Health and Human Services Hosts Medication Take Back Event

Bladen County Health and Human Services agency is taking action against prescription drug abuse by organizing a community-focused Medication Take Back event. Vicky Graham, a Health Educator II at the…

The new Data Science Building embodies the school’s fundamental principles.

The design of the building began in January 2020 with the architectural teams of Hopkins Architects, VMDO, and the University’s Office of the Architect, with construction led by the Gilbane…

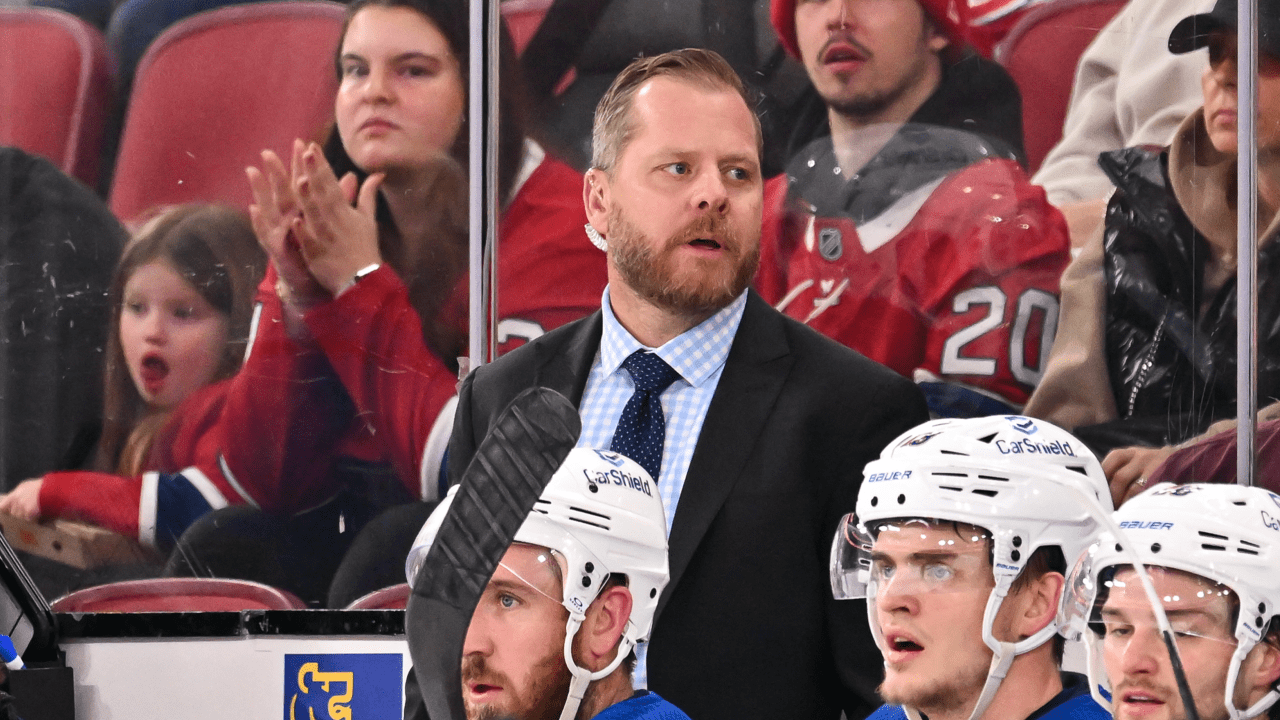

Ott appointed as a member of Team Canada’s coaching staff for World Championship

Hockey Canada has announced that Blues Assistant Coach Steve Ott has been selected as an assistant coach for Team Canada at the 2024 IIHF World Championship. The coaching staff will…

Business News in Jacksonville this Week

This week on Jacksonville Business Edition, the focus is on Comcast RISE, a small business grant program. Comcast RISE is offering $500,000 in grants for entrepreneurs in Northeast Florida. Michelle…

Local Health Agencies and Animal Services Respond to Avian Flu Outbreak

Local doctors and animal experts in San Luis Obispo, California are urging caution around animals as the avian flu spreads across the country. The SLO County Public Health is advising…

Pittsburgh International Airport Introduces Advanced Screening Technology to Enhance Passenger Experience

Facial recognition technology has made its way to Pittsburgh International Airport, similar to my experience at Boston Logan International Airport. TSA agents now ask travelers to step to the side…

Team USA Dominates Slovakia with a 9-0 Victory in Opening Game of U18 World Championship

Midway through the middle frame, Team USA’s top line scored again, this time from Teddy Stiga. Ziemer passed to Hagens as they entered the attacking zone. Hagens drew both defenders…

LIVE: Biden speaks on economic agenda in campaign event in Syracuse, NY

President Joe Biden is expected to make remarks on the economy during a campaign event in Syracuse, New York, on Thursday, starting at 1:30 p.m. ET. This speech follows a…

Enjoy free admission at Pittsburgh Zoo, Carnegie Science Center, and National Aviary this summer – here’s how!

Pittsburgh’s favorite attractions, including the zoo, Carnegie Museum of Natural History, National Aviary, and Phipps Conservatory, will be offering over 100,000 free tickets this summer. The Allegheny Regional Asset District…

Innovation Group North America and Crash Champions Forge Technology Partnership

the development and delivery of innovative solutions that meet the ever-evolving needs of the industry. The collaboration with Crash Champions will further strengthen IG’s position as a leader in the…