- Sat. Apr 20th, 2024

Latest Post

College Football’s Two Minute Warning and New Technological Advancements

The NCAA Football Rules Committee has approved new technology rules for all levels of college football, including the implementation of a two minute warning similar to the NFL. This rule…

Upper Peninsula State Bank assists local business in securing FHLBI grant funding | Local News, Sports, Jobs

Upper Peninsula State Bank, a member of the Federal Home Loan Bank of Indianapolis (FHLBI), recently assisted local small business owner Katelyn Beaver in applying for and receiving funds from…

Caution: Prohibiting Smoking May Impact Your Political Well-Being

In debates regarding the merits of restricting smoking, libertarians are often on the losing end. The idea of a “nanny state” is supported by science, common sense, and public opinion.…

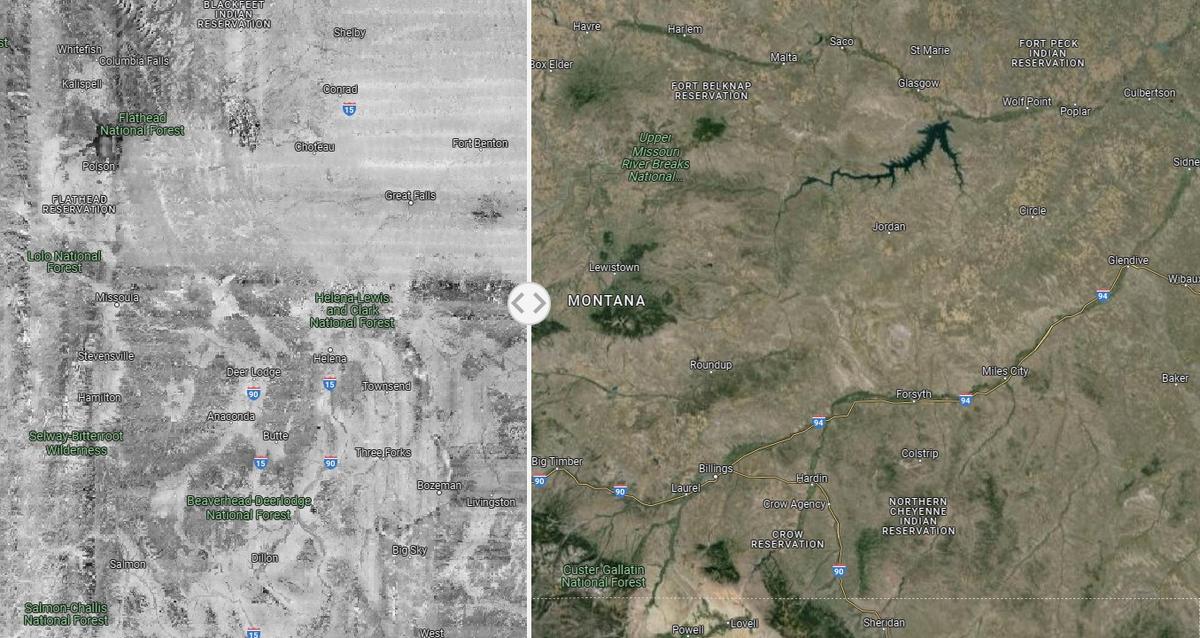

The Changing Landscape of Montana: New Technology Reveals Transformation

Over the past 70 years, Montana has undergone significant changes, including population growth and transformations in towns, cities, and landscapes. The entire western region of the United States has experienced…

IMF APAC Director Krishna Srinivasan states that India’s economy is growing quicker than China, which comes as no surprise.

India has emerged as the fastest-growing economy, surpassing China, which is not surprising given the size of both nations’ economies, according to Krishna Srinivasan, the Director of the IMF’s Asia…

UW Health advises student athletes to schedule summer sports physicals

As the sports season approaches, UW Health is reminding student athletes and their parents to schedule pre-participation physical exams. Seasoned parents understand the necessary steps their children must take in…

U.S. News and World Report recognizes PNW’s Nursing and Business graduate programs

Purdue University Northwest’s graduate programs in Nursing and Business received recognition in the 2024 Best Graduate Program rankings by U.S. News and World Report. The Master of Science in Nursing…

Since the start of the year, Ukraine has been hit by close to 10,000 missiles and guided bombs

President Zelensky of Ukraine has requested NATO to provide at least 7 more Patriot air defense complexes to help protect the country from the ongoing attacks by Russia. In a…

Small Business Open House at EOD – Wednesday April 24, 2:00pm to 3:30pm

I am thrilled to announce our Small Business Open House taking place on Wednesday, April 24 from 2:00pm – 3:30pm at the City Hall Annex in the 2nd floor conference…

Financial Market News: Stay Updated with Stock Market Updates, Economy News, Sensex, Nifty, Global Market Trends, Live IPO Updates from NSE and BSE

The Noida Authority recently took action to reclaim 18 acres of land valued at Rs 308 crore that had been illegally occupied by land mafias. These mafias had encroached upon…