- Sat. Apr 20th, 2024

Latest Post

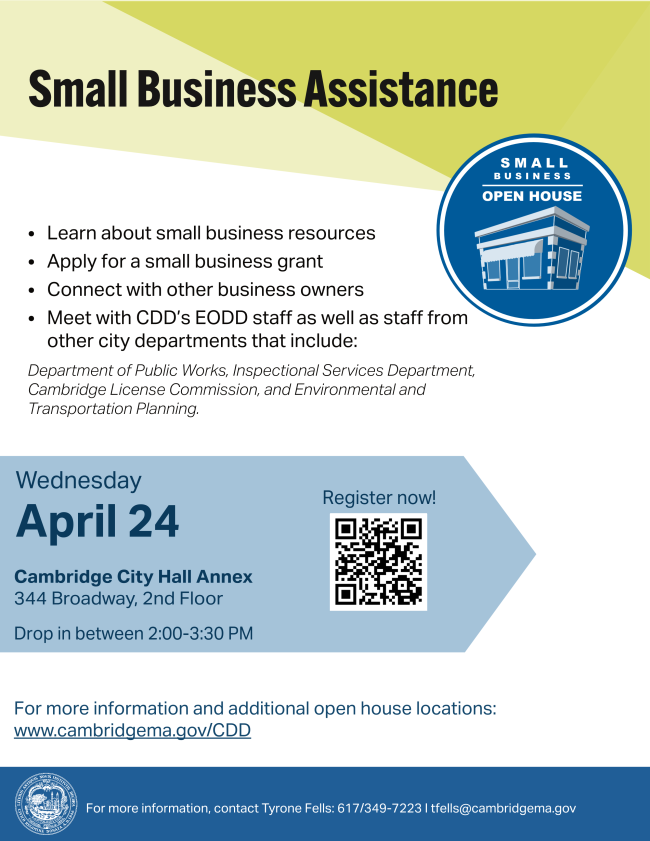

Small Business Open House at EOD – Wednesday April 24, 2:00pm to 3:30pm

I am thrilled to announce our Small Business Open House taking place on Wednesday, April 24 from 2:00pm – 3:30pm at the City Hall Annex in the 2nd floor conference…

Financial Market News: Stay Updated with Stock Market Updates, Economy News, Sensex, Nifty, Global Market Trends, Live IPO Updates from NSE and BSE

The Noida Authority recently took action to reclaim 18 acres of land valued at Rs 308 crore that had been illegally occupied by land mafias. These mafias had encroached upon…

Small Business Association provides support to individuals affected by Key Bridge collapse

In response to the recent bridge collapse, the Small Business Association (SBA) quickly established its first Business Recovery Center to assist those affected by the disaster. In an update provided…

New Cholera Vaccine Receives WHO Prequalification

The World Health Organization WHO recently prequalified the Euvichol-S cholera vaccine on April 19 in order to address the shortage of cholera vaccines. This new vaccine is administered orally and…

Groundbreaking Ceremony for Long-Awaited Science Center at Roanoke College

Roanoke College is preparing to host a groundbreaking ceremony for its new Science Center this Saturday. The idea to construct the center has been in the works since 2011, and…

Gen AI Streamlines Manufacturing Decision-Making at Georgia-Pacific

Georgia-Pacific, a manufacturer of paper goods products and parent company to popular brands like Quilted Northern, Brawny, Dixie, and Vanity Fair, is leveraging generative AI capabilities to enhance their manufacturing…

Top cyclists and rising stars geared up for Tour of the Gila

The Tour of the Gila, now in its 37th year, is one of the few multi-stage bicycle races in the U.S. that has stood the test of time. Held in…

April 19, 2024 – Chicago Bulls face off against Miami Heat

On April 19, 2024, a game took place between the Chicago Bulls and the Miami HEAT. Tyler Herro Jr. led the Miami team with an impressive performance, scoring 24 points,…

Jimmies Softball Divides Doubleheader with Doane – Jamestown Sun

The University of Jamestown faced off against Doane University in a doubleheader that started with a 2-1 win for the Jimmies over the Tigers on Friday, April 19, at the…

Jimmies men’s volleyball defeats Kansas Wesleyan in GPAC semifinals

The University of Jamestown, ranked No. 9, triumphed on their home court in the GPAC tournament by sweeping Kansas Wesleyan University (25-15, 25-12, 25-18) on Friday, April 19, at Harold…