- Sat. Apr 20th, 2024

Latest Post

Use of Facial Recognition Technology in Facilities to Assist Vulnerable Populations with Detection and Location

Advancements in technology have resulted in changing demands that make facial recognition technology valuable for vulnerable populations. The integration of facial recognition technology and behavior analytics can significantly improve safety…

Entrepreneurship and Homelessness in Tulsa: An In-Depth Look at Equality in Business Ownership

Lori Nair, a female business owner in Tulsa, began her shop by chance when her daughter needed a special bag for her wheelchair 22 years ago. She started sewing the…

Report claims UN involvement in violent evictions from World Heritage Sites

A new report by Survival International alleges that the United Nations has been complicit in the violent eviction of Indigenous people from six World Heritage Sites in Africa and Asia.…

Greek economy faces looming clouds

An anti-Israel billboard with a picture of Iranian missiles was seen on a street in Tehran, Iran. This occurs as storm clouds gather over the Greek economy, facing domestic challenges…

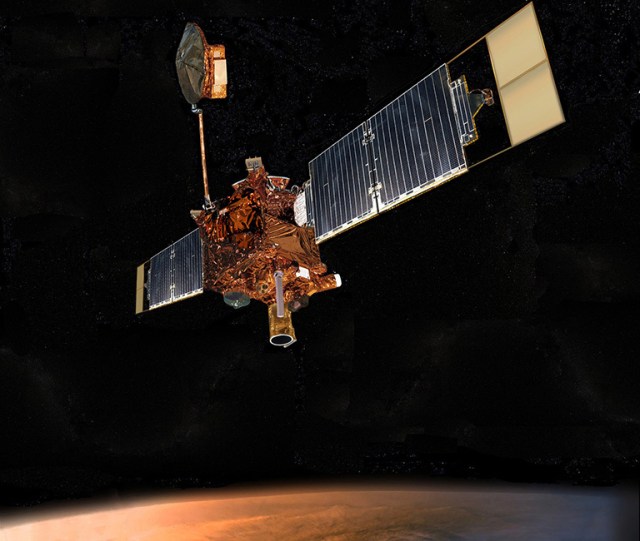

NASA Science: Mars Global Surveyor

Mars Global Surveyor was a spacecraft that orbited Mars for ten years, providing valuable information on the planet’s surface, atmosphere, and interior. Throughout its mission, it revolutionized scientists’ understanding of…

Finance Minister announces Poland to receive $266 million from World Bank for Clean Air program

Poland signed a 250-million-euro agreement with the World Bank to support its Clean Air program, announced Finance Minister Andrzej Domanski. He stated that he discussed global economic challenges and increasing…

Congressman Cohen reveals $21.3 million in grants from the Department of Health and Human Services.

In Washington, Congressman Steve Cohen (TN-9) announced that Memphis Health Center Inc., Porter-Leath, and the Shelby County Board of Education will be receiving grants totaling $21,309,797 from the U.S. Department…

US quartet shatters world record in distance medley relay at Eugene event

Brannon Kidder, Brandon Miller, Isaiah Harris, and Henry Wynne teamed up to break the distance medley relay world record at the Oregon Relays in Eugene, USA. The relay consists of…

Analyzing the Drake vs. the World Conflict

Kendrick Lamar added fuel to the fire in his long-standing tension with Drake by dropping a guest verse on Future and Metro Boomin’s hit song, “Like That.” This move escalated…

Ronnie O’Sullivan on the Hunt for his ‘Turbo Button’ in Preparation for 2024 World Championship Charge

Ronnie O’Sullivan has set his sights on finding a “turbo button” to maintain a high level of performance consistently. As the world No. 1, he has enjoyed a successful season…