- Fri. Apr 26th, 2024

Latest Post

Lerøy invents innovative health supplement made from salmon blood

SINTEF, a research organisation, has found that the aquaculture industry is able to utilise about 94 percent of its raw materials, with only blood being the leftover part that is…

Celebrating World IP Day: Shaping our future through innovation and creativity

World IP Day is a time to recognize the significant role that intellectual property (IP) plays in advancing technology and achieving the Sustainable Development Goals (SDGs) in the EU and…

Oil Prices Expected to Remain Steady Due to Strong Global Economy

According to a poll of economists conducted by Reuters, the global economy is expected to continue its strong performance. This is viewed as positive for oil prices, but there are…

Achievements for Science Club: Recognized with Impact and Excellence Awards

The Super Science Club was awarded Outstanding Club or Organization of the Year at the 2024 Impact and Excellence Awards ceremony held at the DoubleTree by Hilton. During the event,…

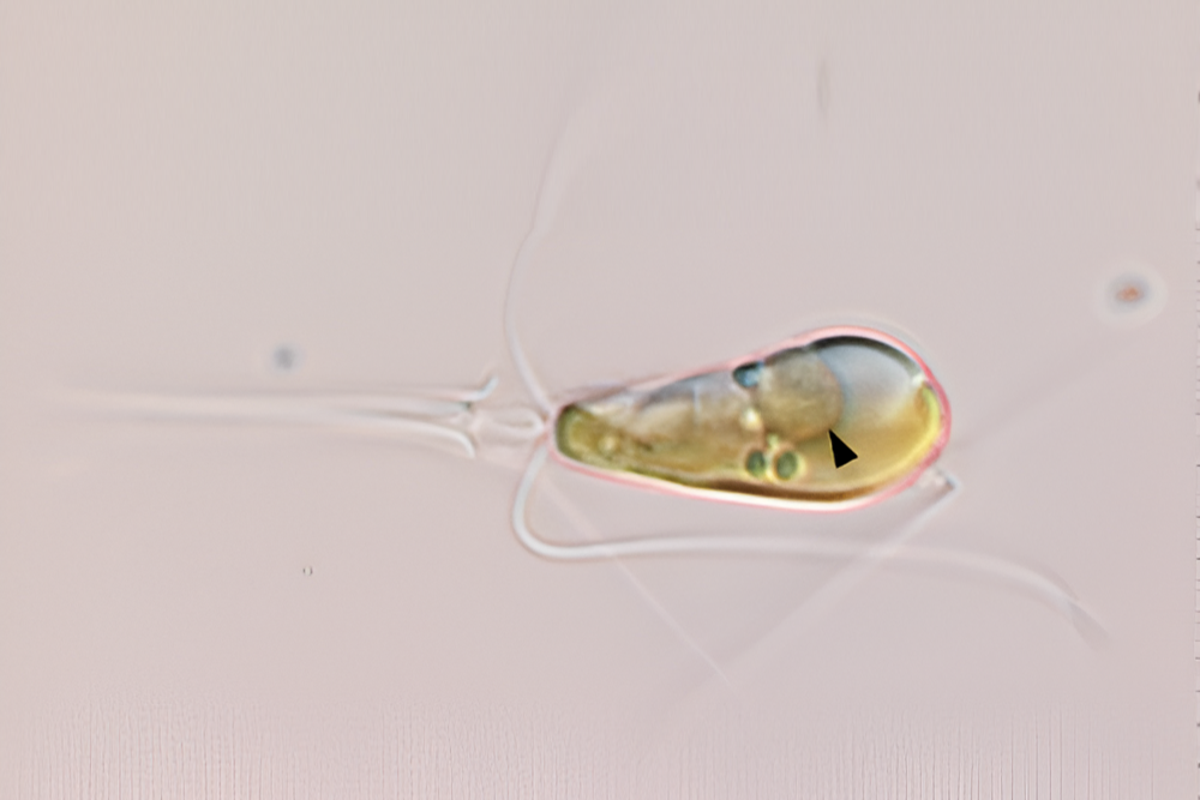

First time in a billion years: Two lifeforms unite as one

Sign up for our Voices Dispatches email to receive a comprehensive digest of the best opinions of the week. Additionally, subscribe to our free weekly Voices newsletter for more updates.…

Honeywell’s innovative hydrocracking technology converts biomass into sustainable aviation fuel

Honeywell has introduced a new hydrocracking technology that can produce sustainable aviation fuel (SAF) from biomass, significantly reducing carbon emissions compared to traditional fossil-based jet fuels. This SAF is 90%…

Hazel Dell’s Music World hosting recycling event to prevent guitar strings and other items from ending up in landfills

Matt Gohlke, the co-owner and general manager of Music World in Hazel Dell, recently realized the impact of disposing of his instruments’ old strings. According to TerraCycle, a recycling company,…

Health Department Announcements

The Department of Health in New Jersey is emphasizing the significance of childhood vaccination during National Infant Immunization Week. This annual event highlights the importance of protecting infants and children…

Penn State offensive tackle Olu Fashanu drafted by the Jets

The New York Jets made a move in the NFL draft Thursday night, selecting Penn State offensive tackle Olu Fashanu with the 11th pick after trading down one spot. The…

Secret Delivery of ATACMS Missile System to Ukraine Threatens Crimea in Russia

The United States confirmed on Wednesday that it had secretly delivered a long-range Atacms missile system to Ukraine, a move that has been condemned by Russia. The delivery consisted of…