- Tue. Apr 23rd, 2024

Latest Post

Overdose deaths in Delaware are decreasing

The Division of Substance Abuse and Mental Health (DSAMH) in the state has identified six strategies to combat overdose deaths, as stated by Joanna Champney, the director. These strategies include…

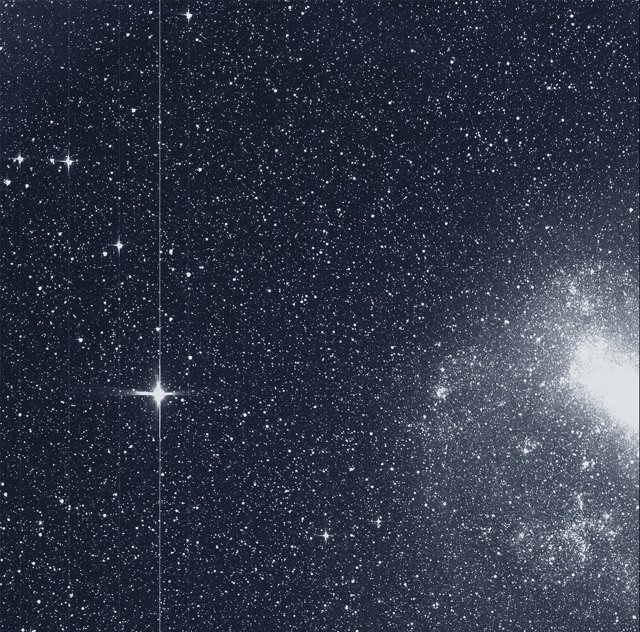

TESS Captures First Science Image in Search for New Worlds

The Transiting Exoplanet Survey Satellite (TESS) recently took a snapshot of a strip of stars and galaxies in the southern sky during a 30-minute period on Tuesday, Aug. 7. This…

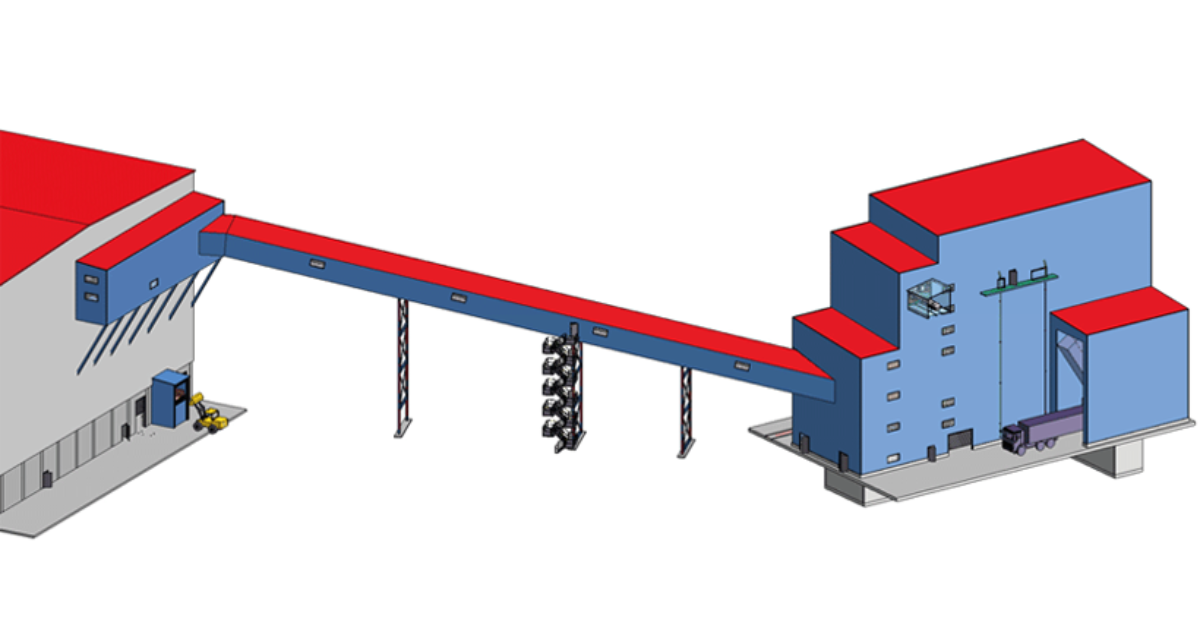

Arglass makes second investment in Zippe’s batch plant technology for glass recycling

Arglass has announced a partnership with Zippe for the construction of their second plant in Valdosta, USA. The project is scheduled for installation in December 2024 and commissioning in Q2…

Montgomery to support small businesses through federal funding

Montgomery County and the city have joined forces to utilize funding from the American Rescue Plan to provide support for small businesses. Mayor Steven Reed emphasized the importance of small…

Physics World reports new record-breaking quantum efficiency achieved by latest photovoltaic 2D material

A new photovoltaic 2D material has broken the quantum efficiency record, according to Physics World. This material has shown promising results in converting light into electricity. The breakthrough in quantum…

Nueces County Public Health Services in Robstown to open five days a week starting soon.

Residents of Robstown and surrounding communities rely on the Johnny Calderon Building for access to healthcare services, but currently, these services are only available twice a week. Officials have recognized…

JD Sports acquisition of U.S. competitor Hibbett in $1.08 billion sportswear agreement

On May 17, 2021, the Prime Minister of England announced that the country could proceed to Stage Three of the reopening plan. This meant that most shops, including indoor establishments,…

Federal Reserve Expected to Cut Rates as US Economy Shows Growth

Stronger economic growth is allowing the Federal Reserve to remain patient, leading to a likely delay in the expected interest-rate cuts. The US economy showed strong growth in the first…

India spice manufacturer assures customers of product safety despite health concerns – DW – 04/23/2024

Indian manufacturer Everest Food Products reassured consumers on Tuesday that their spices are safe for consumption after Singapore and Hong Kong raised concerns about allegedly high levels of a cancer-causing…

Florida Cities Dominate Top 10 List for Best Business Startups

The Sunshine State has become a top choice for businesses due to its low corporate tax rates and high number of investors, making it attractive for entrepreneurs. Among the cities…