- Sat. Apr 20th, 2024

Latest Post

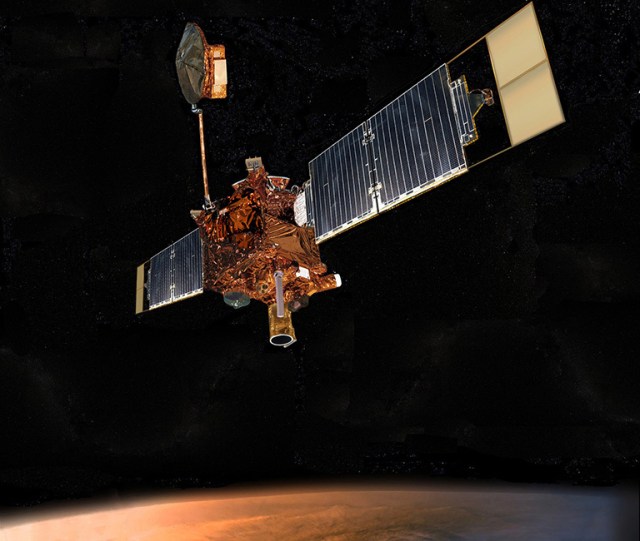

NASA Science: Mars Global Surveyor

Mars Global Surveyor was a spacecraft that orbited Mars for ten years, providing valuable information on the planet’s surface, atmosphere, and interior. Throughout its mission, it revolutionized scientists’ understanding of…

Finance Minister announces Poland to receive $266 million from World Bank for Clean Air program

Poland signed a 250-million-euro agreement with the World Bank to support its Clean Air program, announced Finance Minister Andrzej Domanski. He stated that he discussed global economic challenges and increasing…

Congressman Cohen reveals $21.3 million in grants from the Department of Health and Human Services.

In Washington, Congressman Steve Cohen (TN-9) announced that Memphis Health Center Inc., Porter-Leath, and the Shelby County Board of Education will be receiving grants totaling $21,309,797 from the U.S. Department…

US quartet shatters world record in distance medley relay at Eugene event

Brannon Kidder, Brandon Miller, Isaiah Harris, and Henry Wynne teamed up to break the distance medley relay world record at the Oregon Relays in Eugene, USA. The relay consists of…

Analyzing the Drake vs. the World Conflict

Kendrick Lamar added fuel to the fire in his long-standing tension with Drake by dropping a guest verse on Future and Metro Boomin’s hit song, “Like That.” This move escalated…

Ronnie O’Sullivan on the Hunt for his ‘Turbo Button’ in Preparation for 2024 World Championship Charge

Ronnie O’Sullivan has set his sights on finding a “turbo button” to maintain a high level of performance consistently. As the world No. 1, he has enjoyed a successful season…

University of Tokyo Researchers Develop AI Tool that Forecasts Employee Turnover

Bosses who are concerned about employee turnover or are unsure of how long their employees will stay with the company will soon have access to artificial intelligence (AI) technology that…

Company replaces humanoid robot with a model that has practical real-world capabilities

A U.S. company, Boston Dynamics, announced plans to upgrade its humanoid robot with a new model designed for real-world commercial and industrial applications. The company stated that its hydraulic Atlas…

Small business born from an LSU student’s passion

A unique small business in Baton Rouge combines chocolate and science, run by an LSU student and her mother. Maram Khalaf, a biological science major at LSU, uses her research…

Boston Businesses Thrilled for Celtics’ and Bruins’ Playoff Rivalries – NBC Boston

When it comes to the economic impact of Boston sports, the month of April started off strong with the Boston Marathon. This event marks the beginning of a busy visitor…