- Wed. Apr 24th, 2024

Latest Post

What’s next for TikTok in the US after the Senate vote on the app?

Senator Marco Rubio, the top Republican on the Intelligence Committee, criticized the Chinese Communist Party’s control over popular American app TikTok, calling it dangerously short-sighted. He expressed support for a…

Egypt signs deal to purchase 500,000 tons of sugar

Cairo: “Al Khaleej” Dr. Ali Al-Moselhi, Minister of Supply and Internal Trade in Egypt, has announced that the Ministry has implemented plans to establish a strategic reserve of essential commodities.…

Protests in Israel after hostage video sparks USA’s interest in Gaza mass graves

The USA has expressed dissatisfaction with Israel’s statements regarding reports of mass graves in the Gaza Strip. US National Security Advisor Jake Sullivan called the reports “deeply disturbing” and stated…

Deciding with the farm’s fiscal well-being in consideration

High interest rates and lower commodity prices are continuing to pose a threat to the financial health of farms. As a result, farmers like Grant Strom from west-central Illinois are…

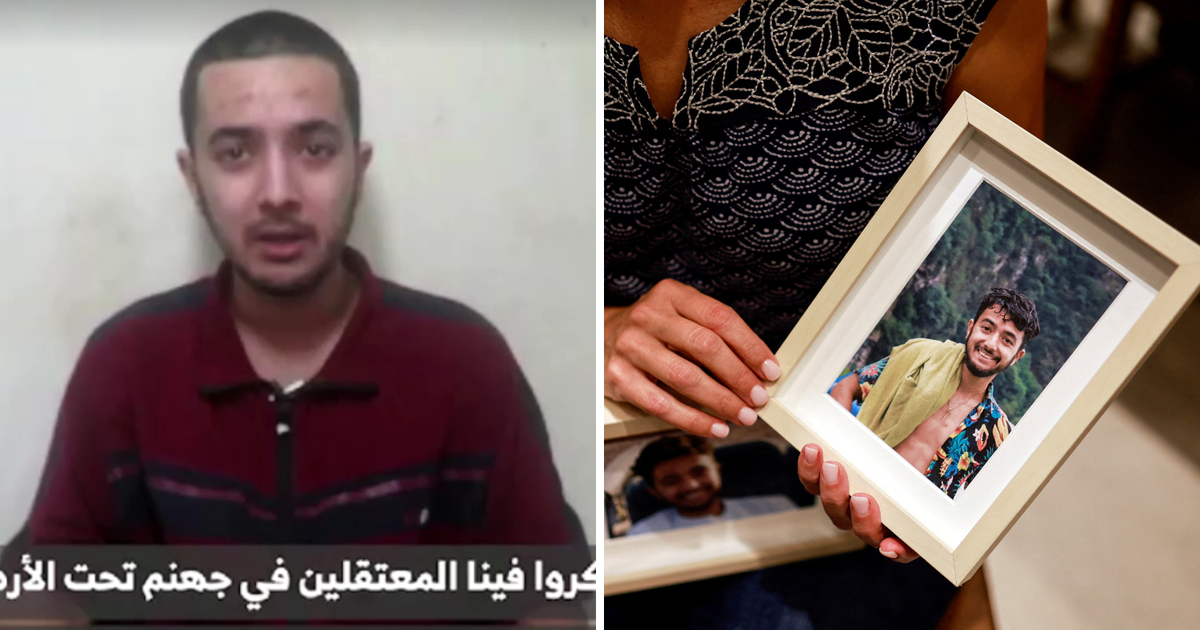

Hamas reveals hostage in video after 200 days in captivity

Hersh Goldberg-Polin, an Israeli with an American passport, was abducted on October 7 at the Nova festival during the Hamas attack on Israel. He was seriously wounded, and his family…

Spotlight on technology needs and opportunities for small fleets by Loadsmart

During FreightWaves’ 3PL Summit on Wednesday, LoadSmart’s vice president of digital sales, Casey Monahan, participated in a fireside chat with Grace Sharkey. The discussion focused on leveraging technology for fleet…

Duralex awaits buyer in receivership: Can anyone save us like Pyrex did?

For the fourth time in twenty years, the glassmaker Duralex has found itself in receivership. The Orléans commercial court made the decision on Wednesday, April 24, after a one-hour hearing…

Russia Arrests World Chess Champion Garry Kasparov in Absentia

The Syktyvkar city court has issued an arrest in absentia for world chess champion Garry Kasparov, ex-State Duma deputy Gennady Gudkov, co-founder of the Free Russia Forum Ivan Tyutrin, and…

Kim Petras pulls out of Summer Fest performances due to health issues

Kim Petras recently announced that she will no longer be performing at upcoming festivals this summer due to undisclosed health issues. She shared this news on social media, expressing her…

An Arizona-based medical anthropologist draws on local narratives to enrich environmental science

Researcher Denise Moreno-Ramirez is using oral histories to enhance her environmental science research, shedding light on the impact of neglected toxic sites on communities. Emma Peterson, reporting for Inside Climate…