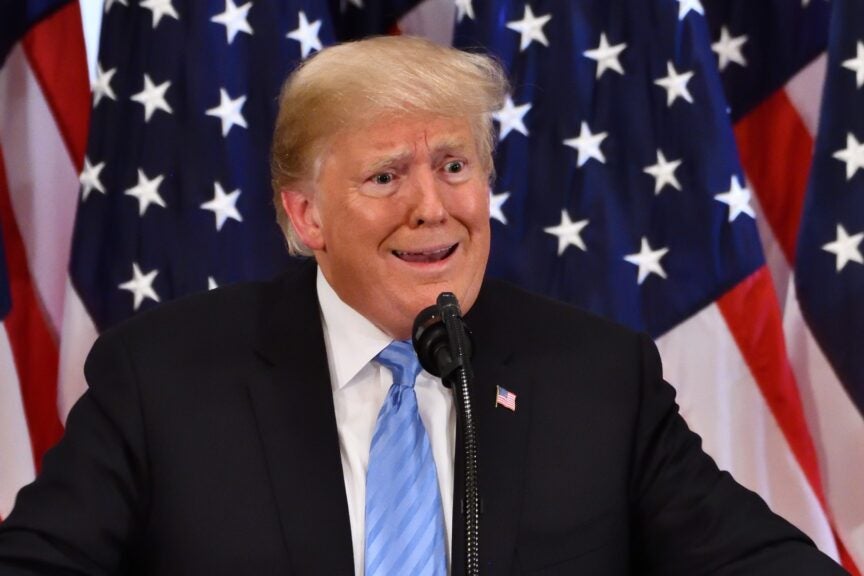

On Monday, shares of Trump Media & Technology Group Corp (DJT) surged more than 21%, as the company, mainly owned by former President Donald Trump, attempted to recover from a significant decline. The stock closed at $33.52, up from just over $27 on Friday, following weeks of losses attributed to Trump’s legal issues. After being found guilty of 34 felony counts related to falsifying business records, the company faced setbacks such as a drop in stock prices and concerns over stock dilution when the SEC approved the registration of additional shares.

Last week, the company announced that it expected to generate over $69.4 million from warrants exercised on Thursday and Friday, which helped boost the stock price. However, TMTG’s stock is currently the most expensive to borrow in the U.S., resulting in significant losses for short sellers totaling around $178 million in year-to-date mark-to-market losses, including $32 million from Monday’s surge.

In other news, Trump is reportedly in talks to speak at the upcoming Bitcoin 2024 convention scheduled to take place in Nashville at the end of July. This appearance would showcase Trump’s support for cryptocurrency, in contrast to President Biden’s more reserved stance on digital currency. The convention, organized by Bitcoin Magazine, is set for July 25-27, just a week after the Republican National Convention. Apart from Trump, other notable speakers expected at the event include Independent candidate Robert F. Kennedy Jr., former GOP candidate Vivek Ramaswamy, and Tennessee Senators Bill Hagerty and Marsha Blackburn.

Trump’s pro-crypto stance has garnered support from wealthy crypto investors backing his campaign, which has contributed to TMTG stock gaining 164% over the last 12 months. As of Tuesday premarket trading, DJT shares were up by 8.32% to $36.31.

Please note that this content was partially generated with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Shutterstock.