- Sat. Apr 20th, 2024

Latest Post

Area businesses get ready for tourist season as it approaches: A business round-up

The signals of a strong local economy in Narragansett, Rhode Island are bringing optimism for the upcoming busy tourist season. According to Joe Viele, the executive director of the Southern…

Duplantis shatters pole vault world record at Xiamen competition

Swedish pole vault star Mondo Duplantis made headlines once again by breaking the world record for the eighth time at the opening Wanda Diamond League meeting in Xiamen. Clearing 6.24m…

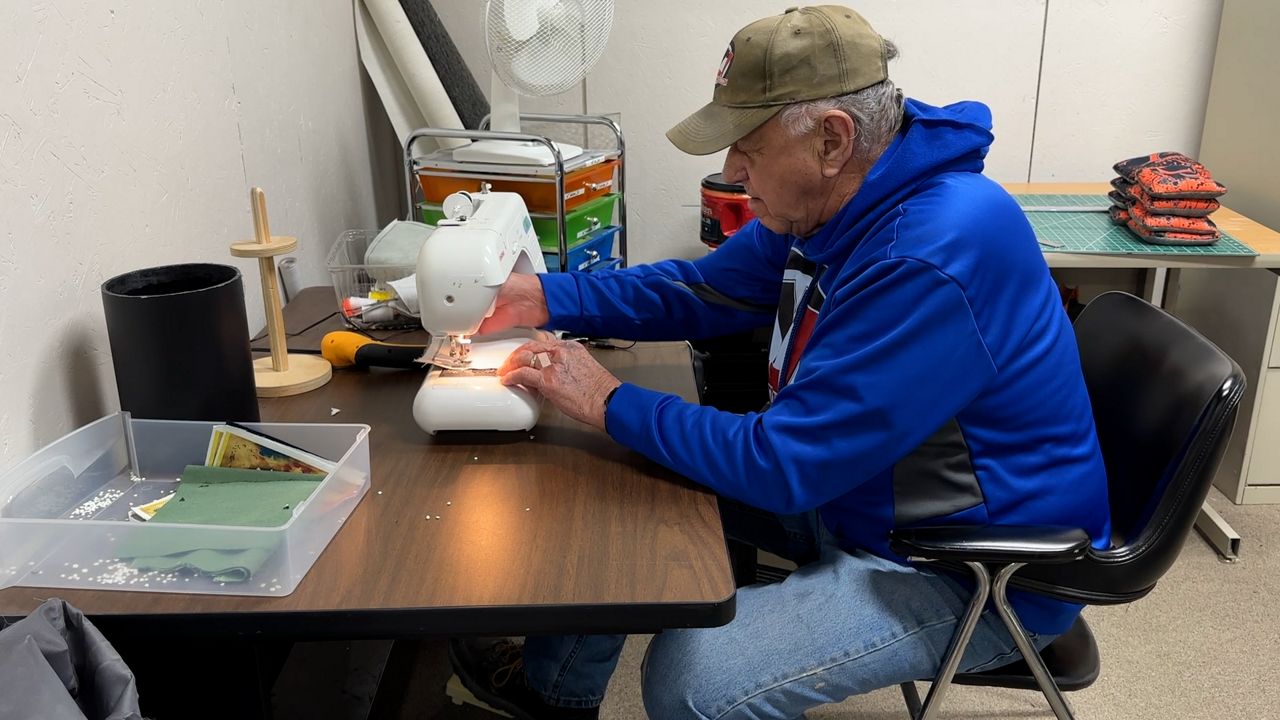

Local family-owned business offers unique handcrafted cornhole items

A farmer and his family have made a transition to a new profession in the hopes of growing the sport of cornhole and their business. They handcraft cornhole boards, bags,…

FLASH: Duplantis Shatters World Record in Pole Vault, Soaring to 6.24m in Xiamen | BREAKING NEWS

Mondo Duplantis made a spectacular start to the 2024 Wanda Diamond League season in Xiamen on Saturday, breaking his own world pole vault record with a height of 6.24m. The…

Elon Musk delays India trip due to Tesla commitments

Elon Musk, the CEO of Tesla, has postponed his planned trip to India due to “very heavy” obligations at Tesla. His visit was expected to include a meeting with Prime…

Armand Duplantis Sets New Pole Vault World Record, Defeating Previous Mark

At the World Athletics Championships in Budapest, Sweden’s Armand Duplantis competed in the men’s pole vault final, showcasing his skills on August 26, 2023. Known as “Mondo,” Duplantis began his…

Princess of Wales making good progress in cancer recovery

Kate Middleton’s cancer recovery is progressing well, according to an expert who believes Prince William’s recent public appearances are a signal that the royal family is returning to a sense…

IMF and World Bank steering committee highlights importance of accountability as reforms progress

The steering committee for both the International Monetary Fund and the World Bank highlighted the importance of broader accountability as the institutions implemented reforms to address climate change and other…

Tang Qianting Sets New 100 Breast Asian Record with Time of 1:04.68

The 2024 Chinese National Swimming Championships saw the first Asian Record being broken in the women’s 100m breaststroke event. 20-year-old Tang Qianting swam the fastest time of her life, finishing…

Rochester Institute of Technology Combines Arts and Tech with $120 Million SHED

The new gateway to the campus of the Rochester Institute of Technology features the 180,000-square-foot Student Hall for Exploration and Development. Unlike what one might expect from a tech-focused campus,…