- Sat. Apr 27th, 2024

Latest Post

Exploring Opportunities in the Chippewa Valley: Gundersen Health System’s Consideration

Gundersen Health System is exploring potential opportunities in the Chippewa Valley region, as stated in a press release. The organization, along with Bellin Health, is committed to providing accessible care…

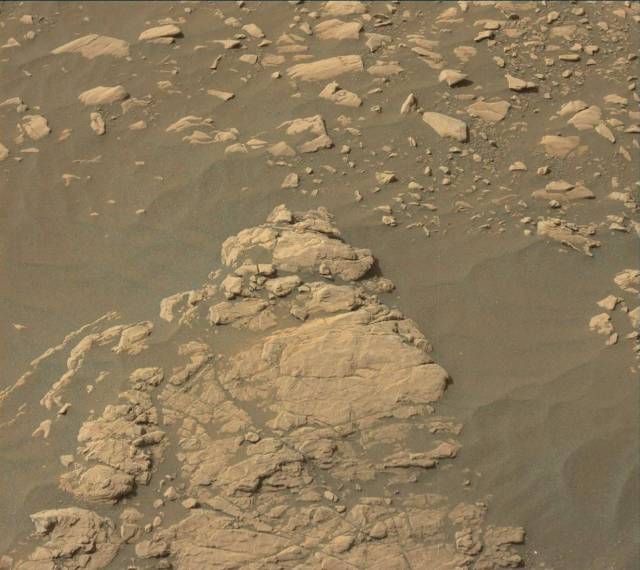

Sol 2367: Aberlady’s Lucky Day

Our short drive on Monday was successful as it brought two potential drill targets into clearer view. Among these targets, the prime candidate named “Aberlady” showed similar color, structure, and…

Country spends $50 billion on missiles, not planes

The trend of increasing defense budgets has been noticed in the past year, primarily from European Union countries, but it is now spreading globally. European countries are supporting Ukraine in…

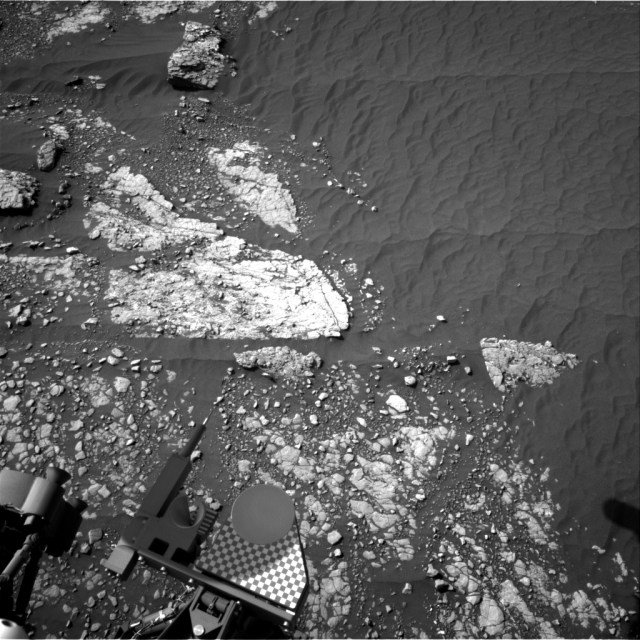

Week on Mars: Sols 2247-2249 Transformed

This week was a busy one for Curiosity as we wrapped up the Highfield drill site campaign. As the Surface Properties Scientist (SPS) on shift, there were no new activities…

Sol 2415: Cairn today, drilling tomorrow?

After a short six-meter drive to “Hallaig,” the science team began their investigation at a new potential drill target called “Broad Cairn.” This spot was identified as a flat area…

26 Iowa athletes bring lawsuit regarding the surveillance of betting through geolocation tracking

Privacy remains a crucial issue in America, with clear boundaries set on the government’s ability to intrude upon it. In Iowa, 26 athletes have taken legal action over geolocation tracking…

Sol 2256: The Search for the Elusive Red Jura Persists

After a successful weekend of activities and driving, our team was excited to wake up on Sol 2256 and prepare for contact science and drilling on Mars. However, the terrain…

Sports Medicine Report: Sporting Player Questionable for Match against Minnesota | April 27, 2024

Sports Medicine Report is SportingKC.com’s update on the team’s health ahead of upcoming matches. Presented by Children’s Mercy Kansas City, all details come from the league’s official Player Status Report…

Sols 2284-2285: A Spectacular Monday on Mars

Today on Mars, the planning day went very smoothly, starting off with a science block filled with various spectroscopic ChemCam observations. The ChemCam instrument can be used in both passive…

Consuming Certain Foods Can Lower the Risk of Cancer, Diabetes, and Dementia

Consuming a diet rich in tomatoes, olive oil, spinach, salmon, tuna, and oranges has been shown to improve mental health and reduce the risk of serious diseases like cardiovascular disease,…