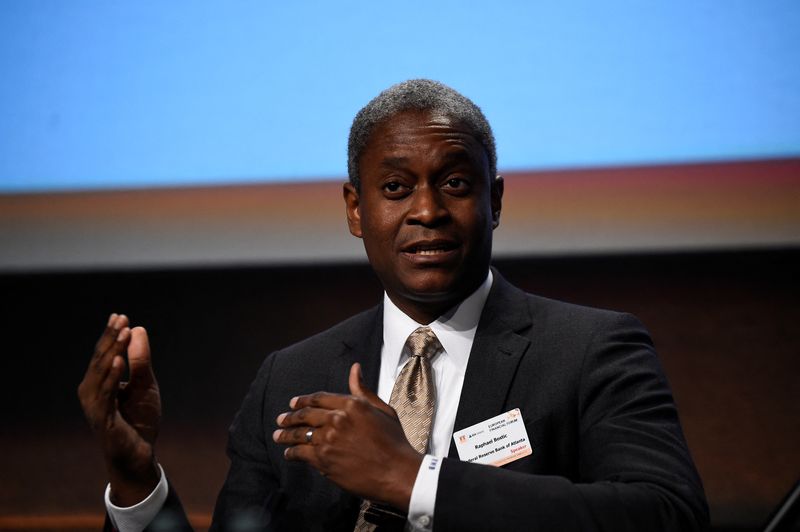

The U.S. Federal Reserve is expected to lower interest rates this year, although the timing of the rate cuts is still uncertain. Atlanta Federal Reserve President Raphael Bostic expressed his belief in a Reuters interview that interest rates could be reduced this year, despite inflation remaining above the central bank’s target in the first quarter. Bostic mentioned that most employers he spoke to are anticipating a return to pre-pandemic wage growth, except for tech companies who have reached their pricing limit. This anticipated inflation reduction could lead to interest rate cuts as the year progresses.

Bostic acknowledged that it may take a couple of months to confirm this downward trend in inflation, but he remains hopeful that it will happen. He emphasized that slowing down inflation is essential to reaching the Fed’s 2% target and that robust job growth is still ongoing. The Federal Open Market Committee recently voted to maintain the benchmark interest rate within the 5.25%-5.50% range, a decision supported by Bostic. However, he noted that he is prepared to raise interest rates if inflation does not decrease.

Bostic’s remarks from April, where he mentioned the possibility of responding to inflation that deviates from the target, led to a rise in bond yields and a selloff on Wall Street. Despite this, he stands by his commitment to monitor inflation and adjust interest rates accordingly to support the economy.