- Fri. Apr 26th, 2024

Latest Post

Germany prepares for possible conflict with Russia over Ukraine, secret document reveals

Germany is actively preparing for potential war scenarios, as revealed in a secret document cited by The Telegraph. German army leaders are developing plans to support American soldiers moving toward…

European and Asian Stock Markets on the Rise; US Core PCE Index to be Released Today

Trading in Europe started with rate increases across various stock exchanges. The Dax strengthened by 0.4%, Potsy added 0.7%, and jackdaw increased by 0.3%. Similar increases were seen in stock…

Court rejects petition to release Mamikon Aslanyan from custody

Mamikon Aslanyan, who served as the leader of Vanadzor for five years, will remain in custody as the court rejected the petition to release him, according to human rights defender…

The Current Diet of Neta Barzilai: A Closer Look

In recent months, there has been a noticeable change in the singer’s appearance as she has shed many kilograms of weight due to a healthy diet and physical activity. Close…

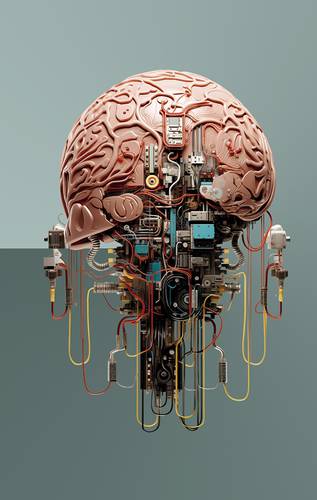

Reflections on AI at the El Aleph Festival

The eighth edition of El Aleph: Festival of Art and Science will take place from May 8 to 19 with the theme Challenges of artificial intelligence and other intelligences. Juan…

Posti Group sees improved profitability despite decrease in turnover at start of year

According to Posti, the decline in turnover is attributed to a drop in demand and political strikes. The Group saw an improvement in profitability in January-March compared to the previous…

Kim Jong Un oversees multiple rocket launcher test in North Korea

A few days after conducting a first simulated “nuclear trigger”, the state news agency KCNA announced the successful launch of a multiple rocket launcher under the supervision of Kim Jong…

Post Journalists Recognized by Associated Press Sports Editors

Sports Editor Jason Murray and Deputy Sports Editor Matt Rennie are pleased to announce that The Washington Post has been awarded two first-place prizes at the annual Associated Press Sports…

Rep. Sewell to Launch National Small Business Week with Virtual “Terri Talks” Discussion

U.S. Rep. Terri Sewell, AL-07, will be hosting a virtual discussion titled “Sipping on Success: The Story of Selma’s Award-Winning Small Business Owner Jackie Smith” on Monday, April 29th at…

Technological Advancements in Compression Technology to Accelerate India’s Hydrogen Economy

PDC Machines and Kirloskar Pneumatic Company Limited (KPCL) have entered into an agreement to offer hydrogen compression solutions throughout India. As part of the agreement, PDC will provide its diaphragm…