- Fri. Apr 26th, 2024

Latest Post

New technology tested by robotic helpers on the space station

The idea of robots assisting astronauts in space, once only seen in science fiction movies, has now become a reality on the International Space Station (ISS). NASA’s trio of free-flying…

Mid-State Literacy Council to Provide Technology Class for Accessing Prescription Drug Resources Online

St. Mark Lutheran Church in Howard is going to host a free technology class focused on online prescription drug resources. The class will take place at 11 a.m. on Tuesday,…

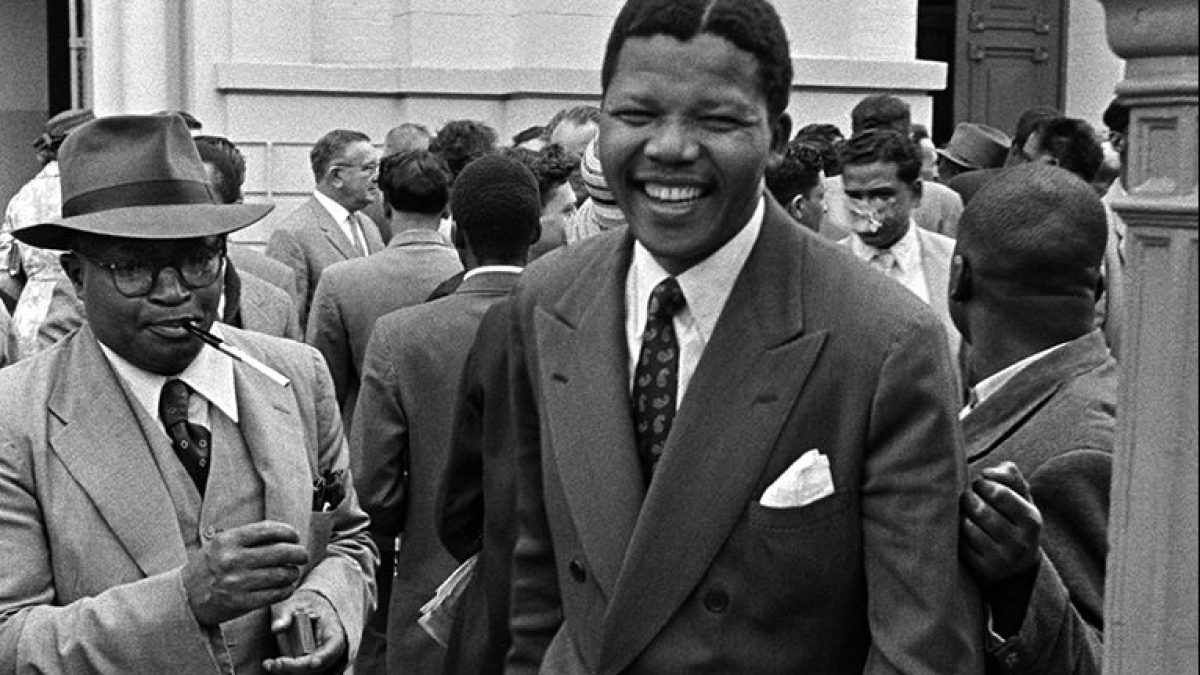

Mandela’s Era: A Visual Journey Through Apartheid South Africa and Human Rights Struggles

Photographer Jurgen Schadeberg dedicated his life to documenting the struggle against apartheid in South Africa. His iconic images captured the resistance and vibrancy of multiracial communities during a time when…

Envair Technology: Formerly Envair and Total Containment Solutions

Envair Technology has been providing clean air solutions to the medical and drug development sectors in the UK and Europe since 1972. TCS, established in 2004, has grown to become…

Restaurants in Bozeman discuss the impact of Downtown Bozeman Restaurant Week on their businesses

Downtown Bozeman is currently hosting its annual Restaurant Week, featuring nearly 30 local eateries on Main Street. The event aims to showcase new food items and menu specials to the…

Lerøy invents innovative health supplement made from salmon blood

SINTEF, a research organisation, has found that the aquaculture industry is able to utilise about 94 percent of its raw materials, with only blood being the leftover part that is…

Celebrating World IP Day: Shaping our future through innovation and creativity

World IP Day is a time to recognize the significant role that intellectual property (IP) plays in advancing technology and achieving the Sustainable Development Goals (SDGs) in the EU and…

Oil Prices Expected to Remain Steady Due to Strong Global Economy

According to a poll of economists conducted by Reuters, the global economy is expected to continue its strong performance. This is viewed as positive for oil prices, but there are…

Achievements for Science Club: Recognized with Impact and Excellence Awards

The Super Science Club was awarded Outstanding Club or Organization of the Year at the 2024 Impact and Excellence Awards ceremony held at the DoubleTree by Hilton. During the event,…

First time in a billion years: Two lifeforms unite as one

Sign up for our Voices Dispatches email to receive a comprehensive digest of the best opinions of the week. Additionally, subscribe to our free weekly Voices newsletter for more updates.…