- Sat. Apr 27th, 2024

Latest Post

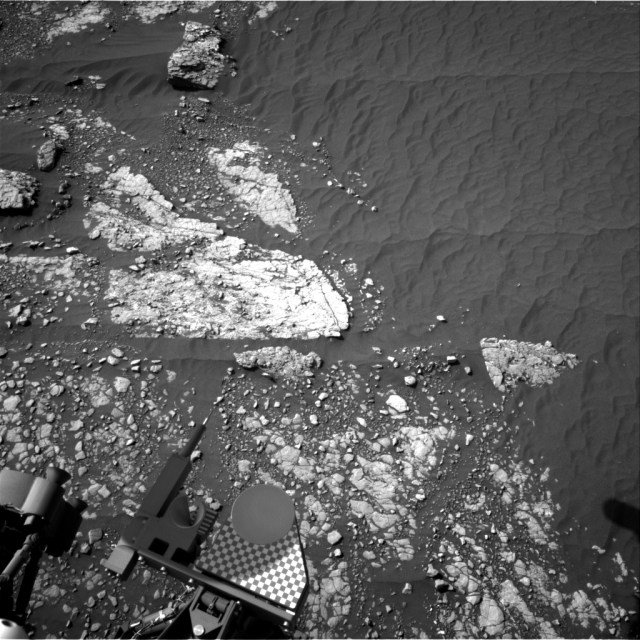

Sol 2415: Cairn today, drilling tomorrow?

After a short six-meter drive to “Hallaig,” the science team began their investigation at a new potential drill target called “Broad Cairn.” This spot was identified as a flat area…

26 Iowa athletes bring lawsuit regarding the surveillance of betting through geolocation tracking

Privacy remains a crucial issue in America, with clear boundaries set on the government’s ability to intrude upon it. In Iowa, 26 athletes have taken legal action over geolocation tracking…

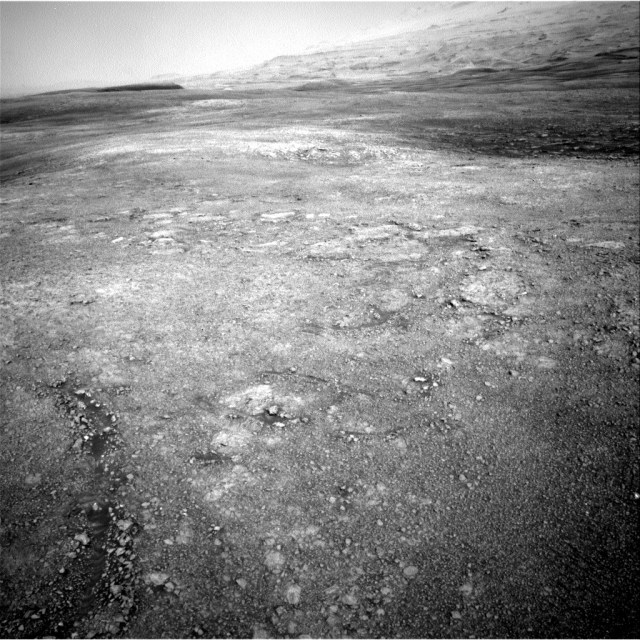

Sol 2256: The Search for the Elusive Red Jura Persists

After a successful weekend of activities and driving, our team was excited to wake up on Sol 2256 and prepare for contact science and drilling on Mars. However, the terrain…

Sports Medicine Report: Sporting Player Questionable for Match against Minnesota | April 27, 2024

Sports Medicine Report is SportingKC.com’s update on the team’s health ahead of upcoming matches. Presented by Children’s Mercy Kansas City, all details come from the league’s official Player Status Report…

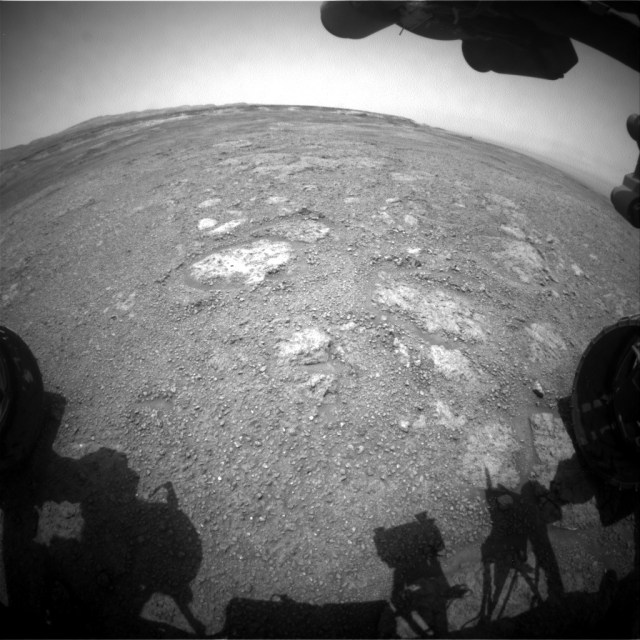

Sols 2284-2285: A Spectacular Monday on Mars

Today on Mars, the planning day went very smoothly, starting off with a science block filled with various spectroscopic ChemCam observations. The ChemCam instrument can be used in both passive…

Consuming Certain Foods Can Lower the Risk of Cancer, Diabetes, and Dementia

Consuming a diet rich in tomatoes, olive oil, spinach, salmon, tuna, and oranges has been shown to improve mental health and reduce the risk of serious diseases like cardiovascular disease,…

Sols 2276-2278: Welcoming the New Year with Light Captured

As we approach the winter solstice and the days begin to lengthen on Earth, the Vera Rubin Ridge campaign on Mars is nearing its conclusion, filled with fascinating scientific discoveries.…

Is Science Settled? April 26, 2024

Ken Ham is a well-known author, blogger, and speaker who focuses on discussing the reliability and authority of the Bible. He is known for his views on climate change science…

Shoe Tree Brewing earns second place at World Beer Cup

Shoe Tree Brewing has been recognized with a silver award in the 2024 World Beer Cup. The award was presented at a ceremony on April 24 at The Venetian in…

We Talk Health Podcast – Donate Life Series Part 2 featuring Sean Kimmins and Bob Arrington

This episode of the We Talk Health Podcast continues our Donate Life Series, which is relevant because April is National Donate Life Month. In this episode, we speak with two…