- Fri. Apr 26th, 2024

Latest Post

Pause for Your Mental Health at NAMIWalks and Wellness Expo on Saturday – San Diego County News Center

San Diegans are encouraged to participate in the annual San Diego NAMI Walks and Mental Wellness Expo taking place this Saturday, April 27, 2024. The event is themed as “I…

Criminal Investigation Started for Traffic Interruption with Burning Tires on Yerevan-Yeraskh Road

Criminal proceedings were initiated on April 24 in connection with the disruption of traffic on the Yerevan-Yeraskh highway caused by burning tires, according to the Investigative Committee. The proceedings were…

A.J. Brown agrees to a three-year, $96 million contract extension with Eagles

Mike Vrabel’s neck might be twitching again as two years after the Eagles traded for receiver A.J. Brown and gave him a massive contract extension, they have agreed to a…

Four Car Manufacturers in Discussions to Acquire Failing Startup

Fisker’s CEO, Henrik Fisker, informed staff during an all-hands meeting on Thursday that the company is engaged in discussions with four automakers about a potential acquisition. Despite the talks, Fisker…

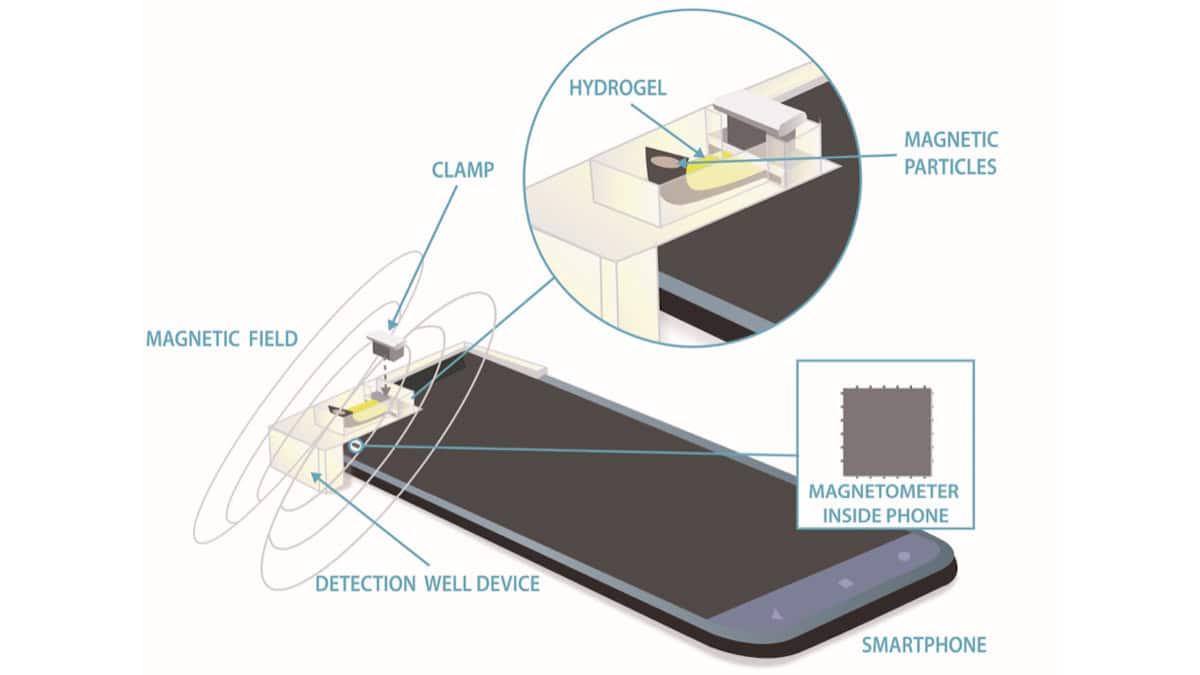

NIST Scientists Create Analyte Sensor Based on Magnetics

NIST researchers have developed a magnetics-based analyte sensor, as reported in Physics World. The sensor utilizes magnetic properties to detect analytes, providing a new method for sensing molecules or substances…

Manufacturers Visit Upper Macungie to Witness Cutting-Edge Automated Technology in Action | Lehigh Valley Regional News

Manufacturers from various regions gathered in Upper Macungie Township, Lehigh County for the Automation and Manufacturing Technology Show hosted by the Manufacturers Resource Center. The show aimed to showcase advanced…

Public Shootings Highlight the Need for Increased Mental Health Support

Shootings have been occurring in public places throughout the region, from a Waffle House to an apartment complex. Witnessing traumatic events can have a lasting impact on individuals, causing them…

Certain Fort Myers downtown business owners are advocating for complimentary employee parking

Some of the business owners in downtown Fort Myers are requesting free parking spaces for their employees. They believe that will help attract and retain staff members. This initiative would…

Pause for Mental Health at NAMIWalks and Wellness Expo on Saturday – San Diego County News Center

San Diegans are encouraged to participate in the annual San Diego NAMI Walks and Mental Wellness Expo taking place this Saturday, April 27, 2024. The theme for this year is…

Winning breweries in Minnesota received medals at the World Beer Cup Awards.

The Canyon Club microbrewery restaurant in Moraga, California was home to a glass of Beta Tested Pilsner on July 4, 2021, as captured in a photo by Smith Collection/Gado/Getty Images.…